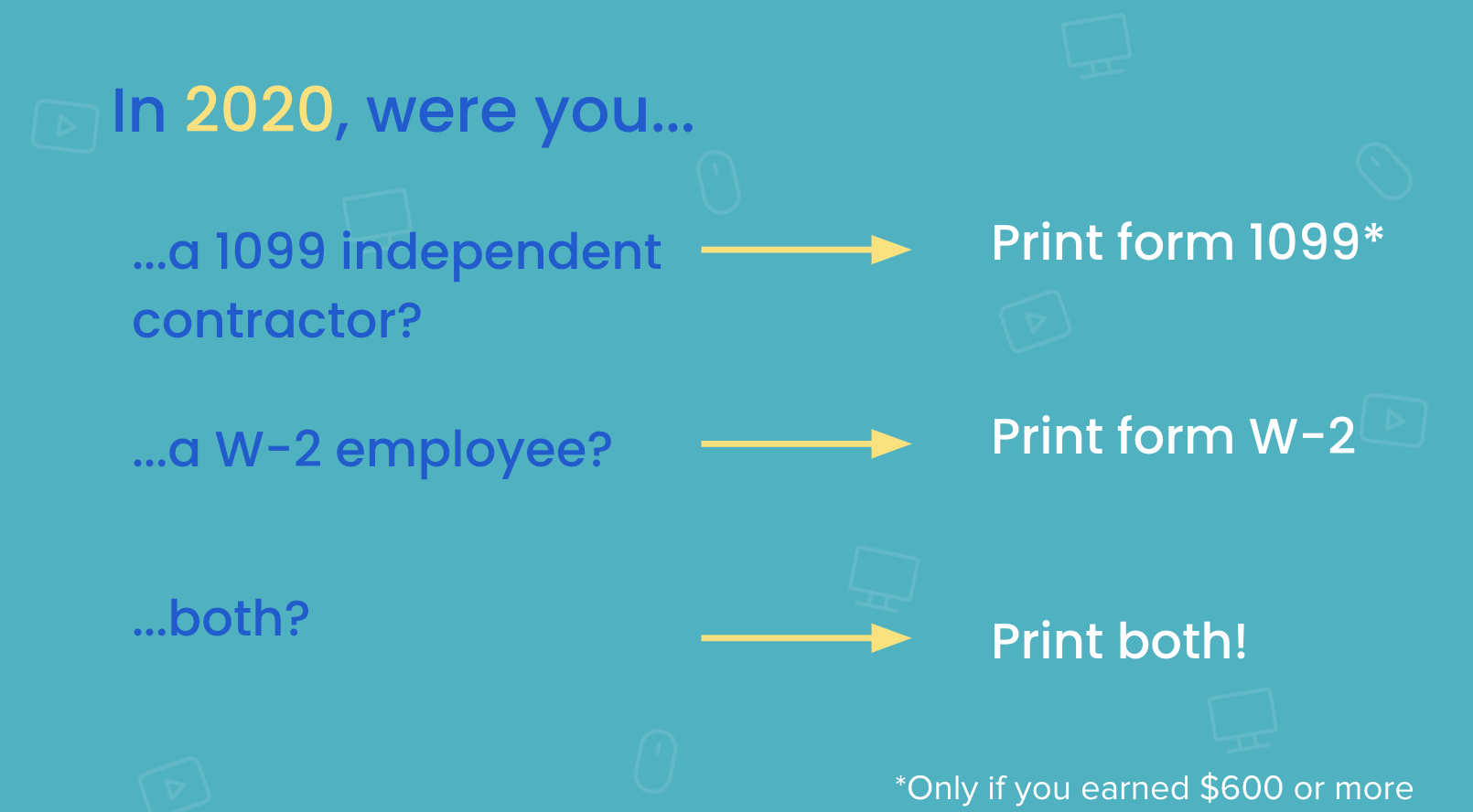

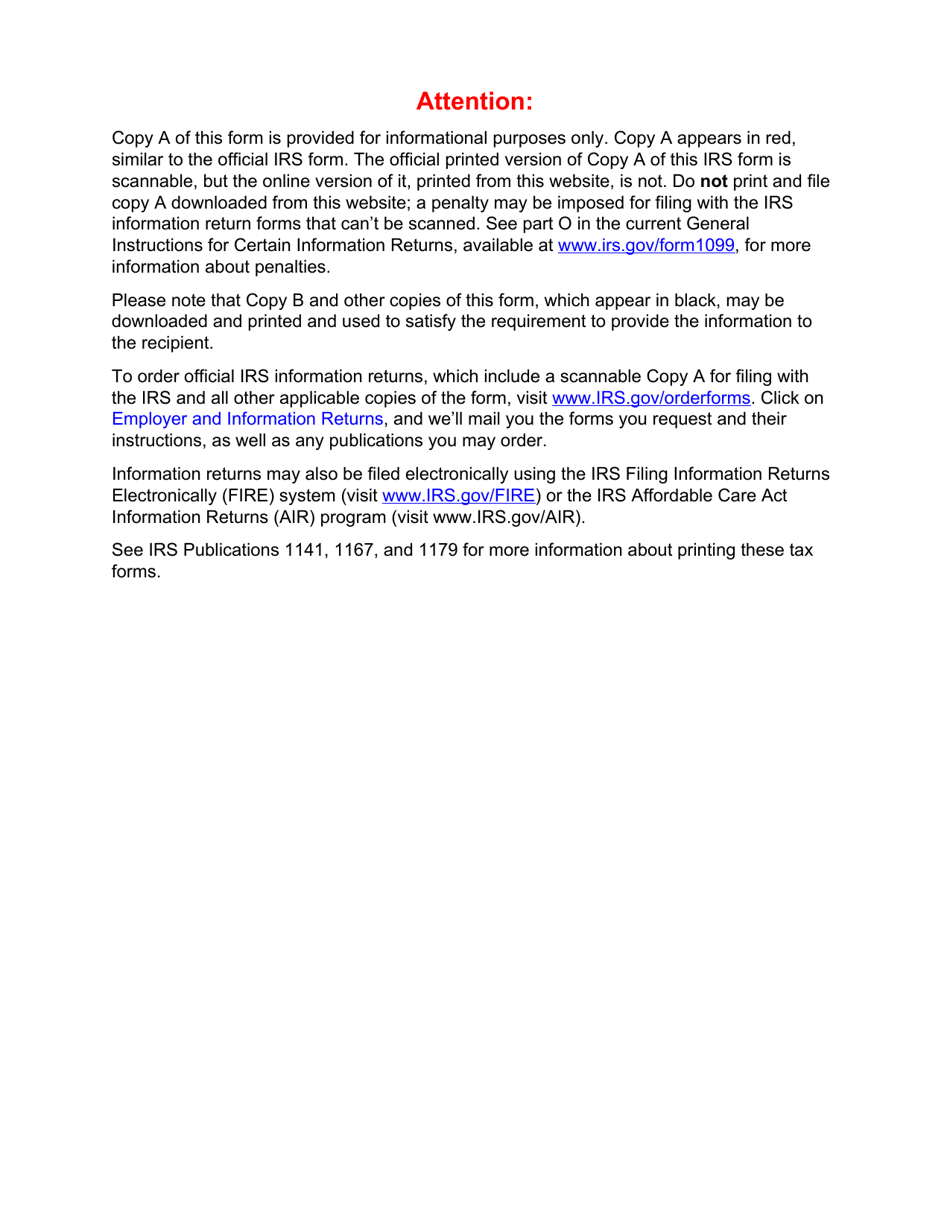

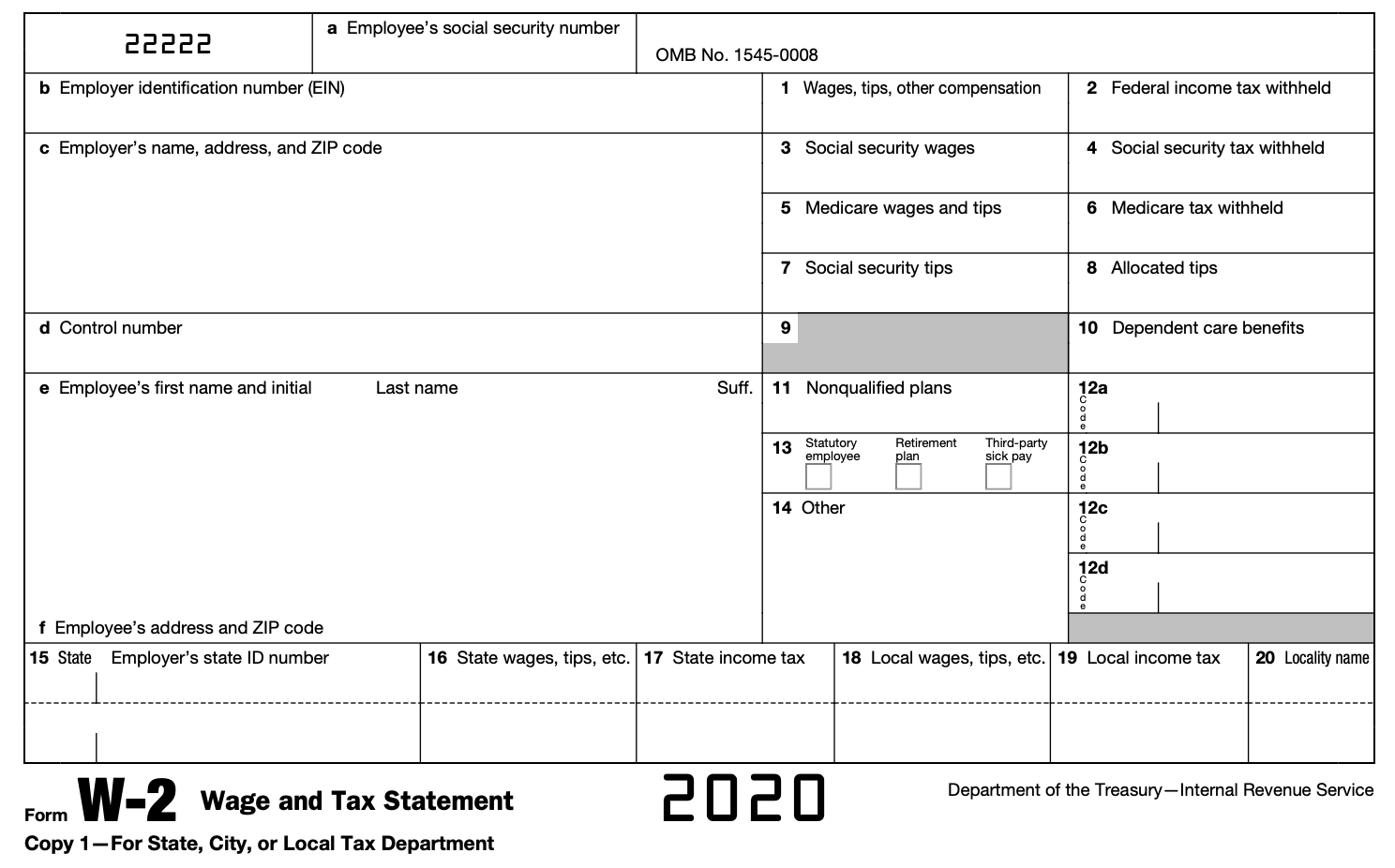

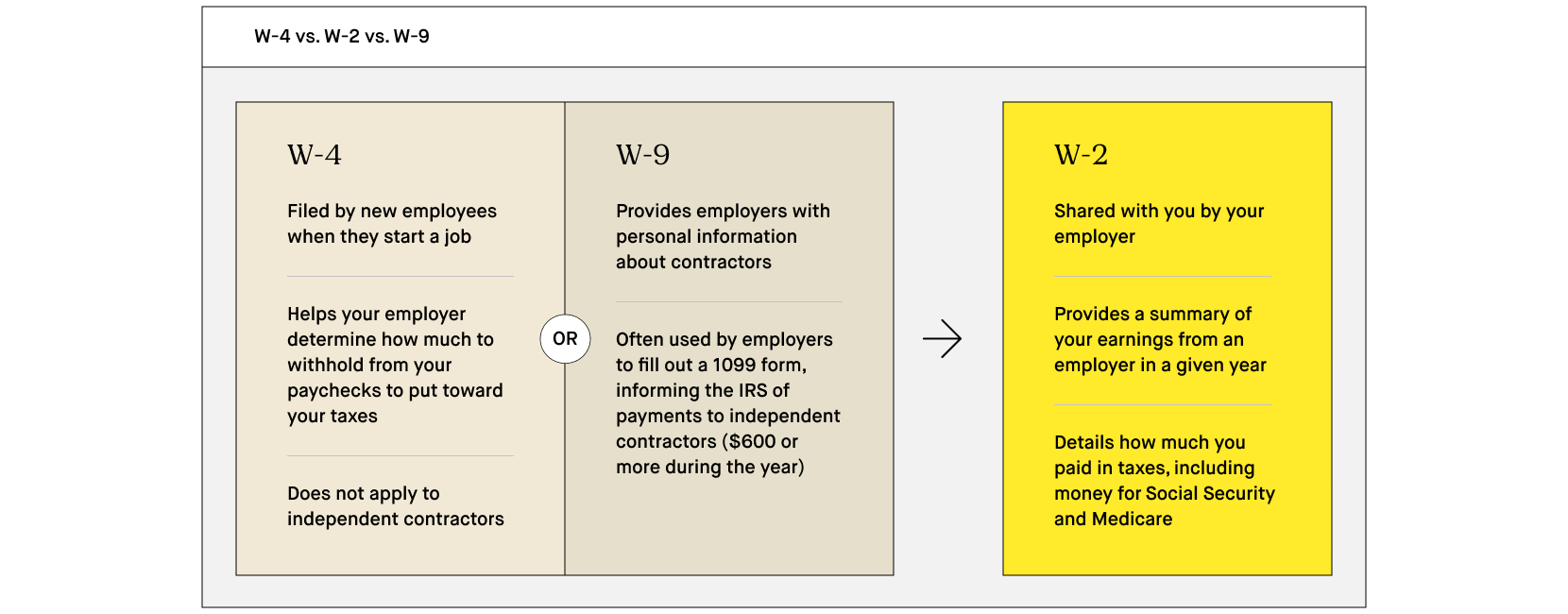

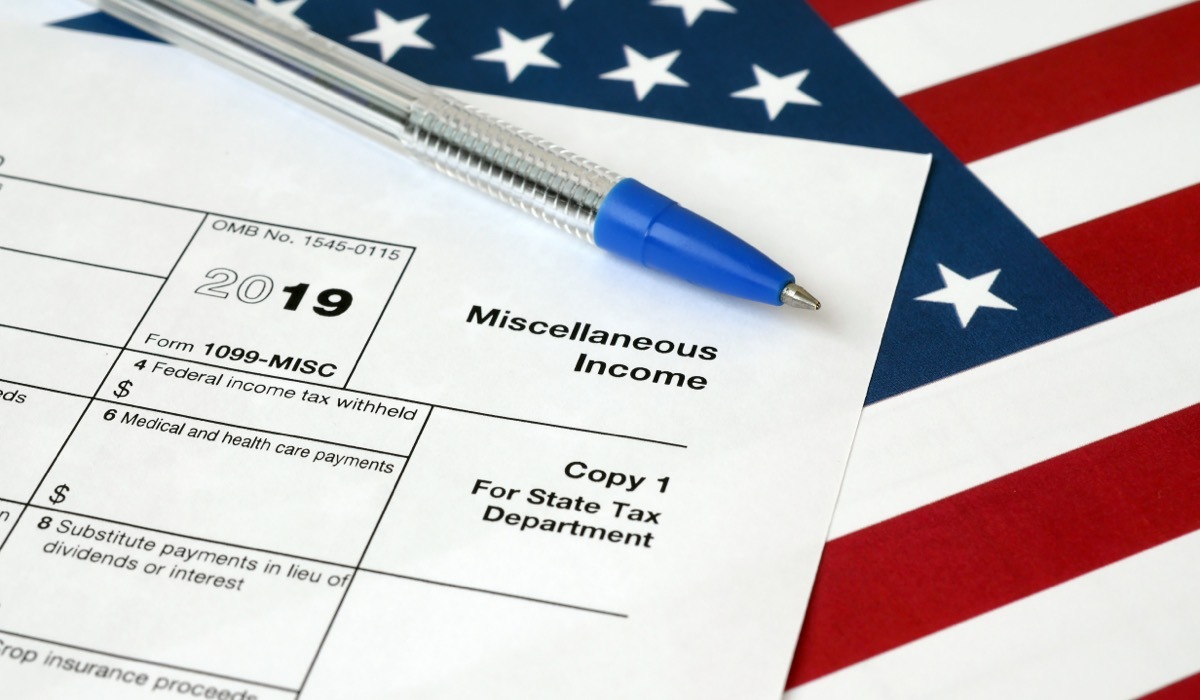

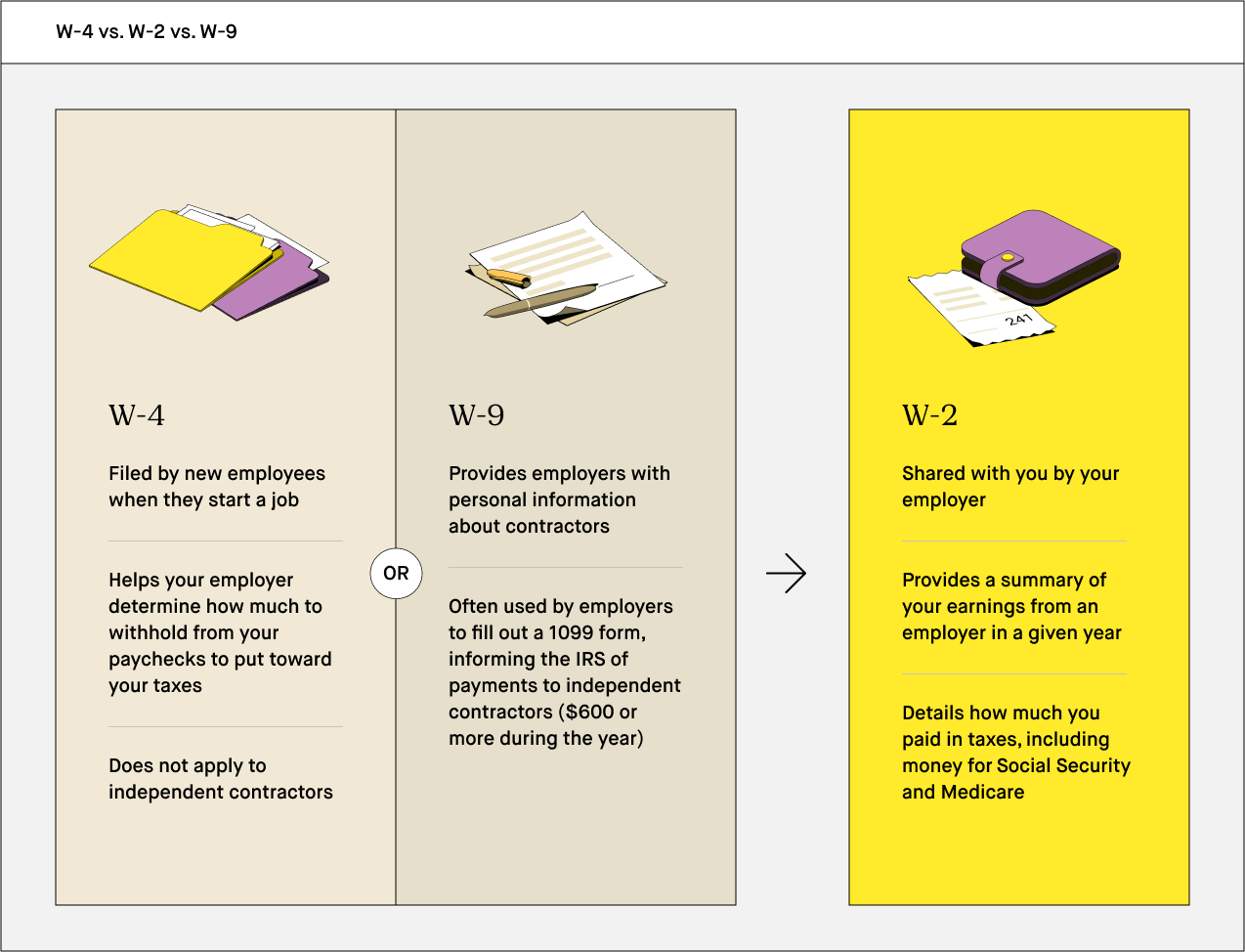

Here, I walk you through applying for the Paycheck Protection Program (PPP) based on your gross income using Womply and their Fast Track application processIndependent Contractor 1099 MISC Form – In general, any business that has paid at least $600 to some individual or any unincorporated organization which has obtained at least two payment amounts from that person or business should problem a 1099 Form to every person or business that has received a minimum of one of these payment quantities This form is utilized by the IRS Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them

1099 Misc Form Copy B Recipient Zbp Forms

Which 1099 for independent contractor

Which 1099 for independent contractor-Have received at least $10 in royalties ;Be aware that starting from the tax year , independent contractors use Form 1099NEC to report nonemployee compensation of $600 or more from a single employer Can one person receive both W2 and 1099 forms?

1099 Misc Form Fillable Printable Download Free Instructions

1099 Form Independent Contractor By Adeline Hubbard 0 Comment While the income of workers is reported on Form W2 by their employer, independent contractors will collect Forms 1099MISC to report income to the IRS11 July Tax Deductions for Independent Contractors in Jason Fairbanks Blog 0 When you autonomously begin a business, you are known as an independent contractor so you may be unsure about the benefit of tax deductions for independent contractors As an independent contractor, you can determine the course of your career, as well as dictate yourThe taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 online to the IRS by March 31st, 21 There are late penalties for payer's who file the information returns late As an independent contractor, you should file

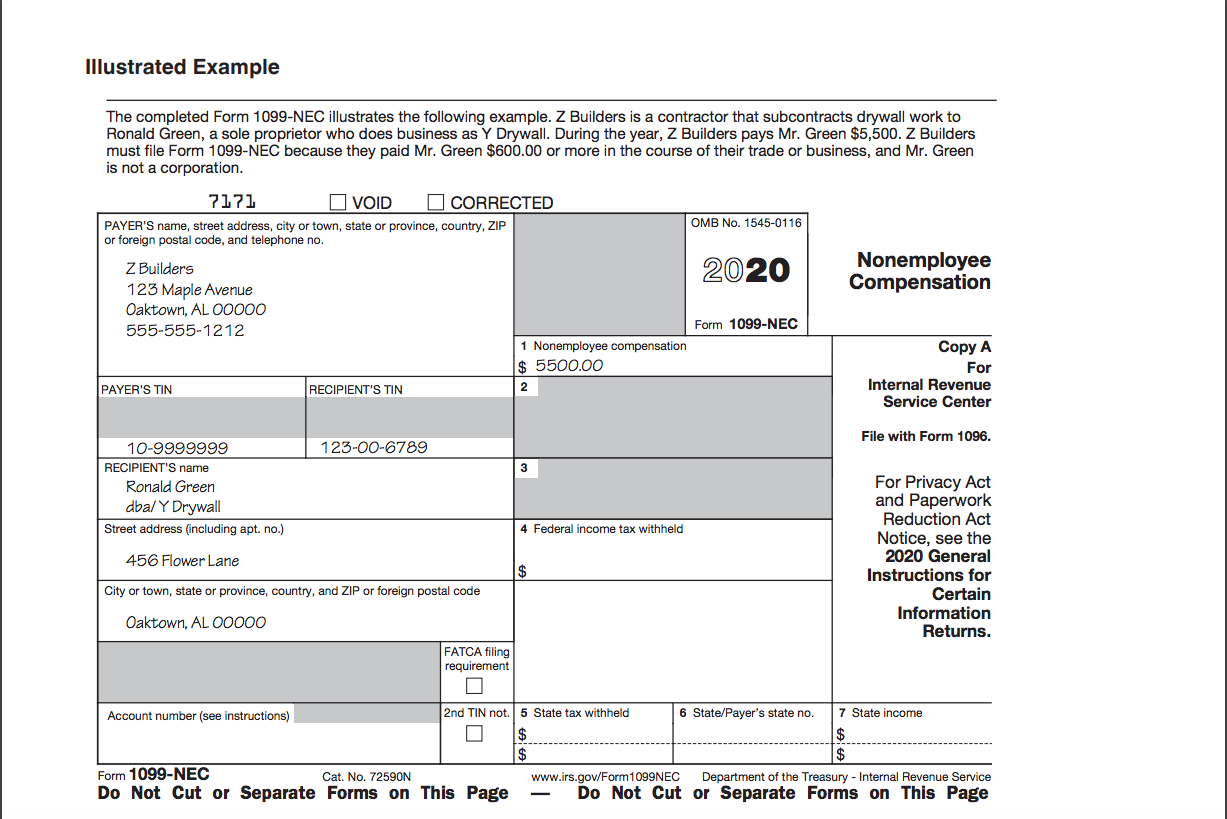

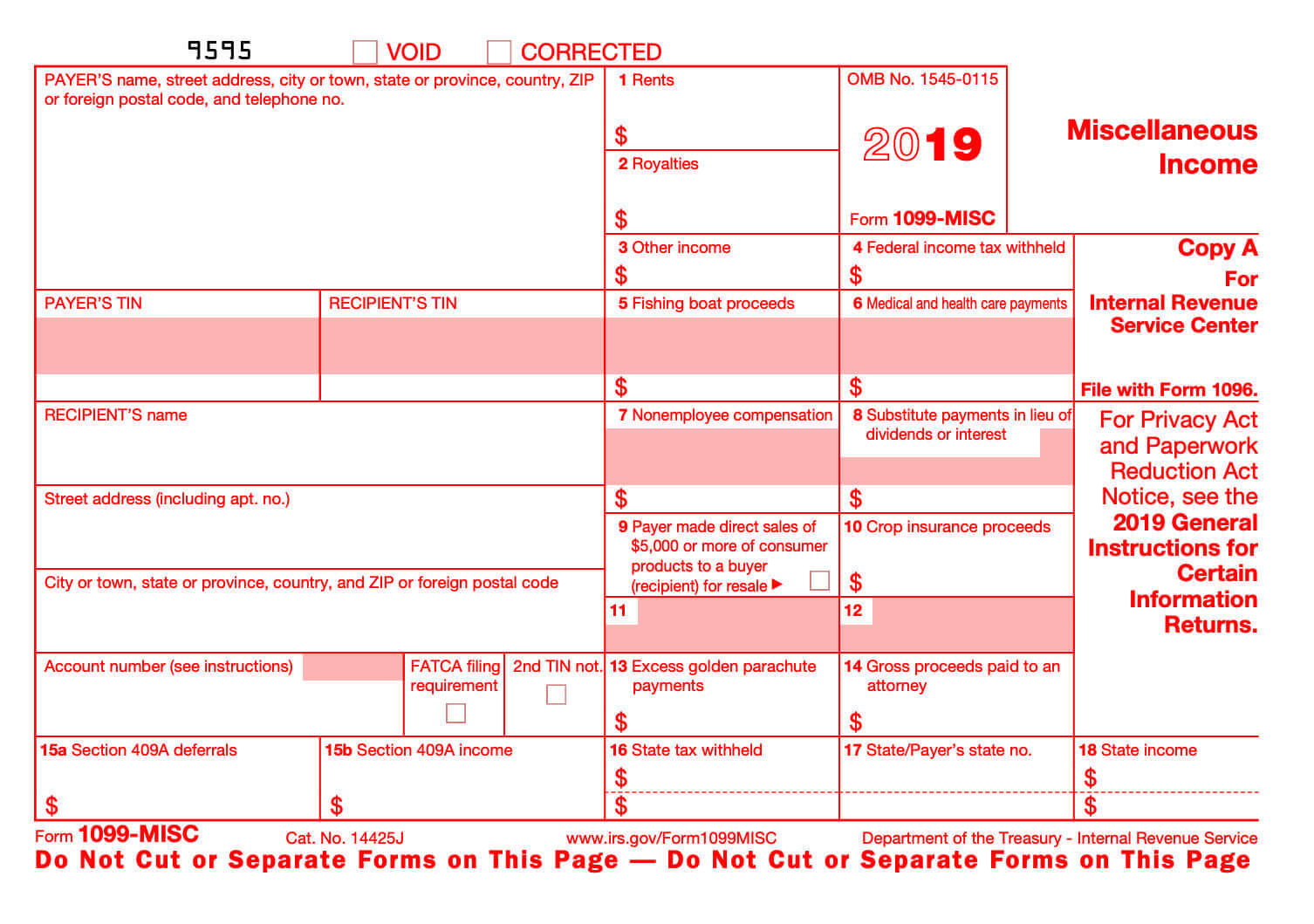

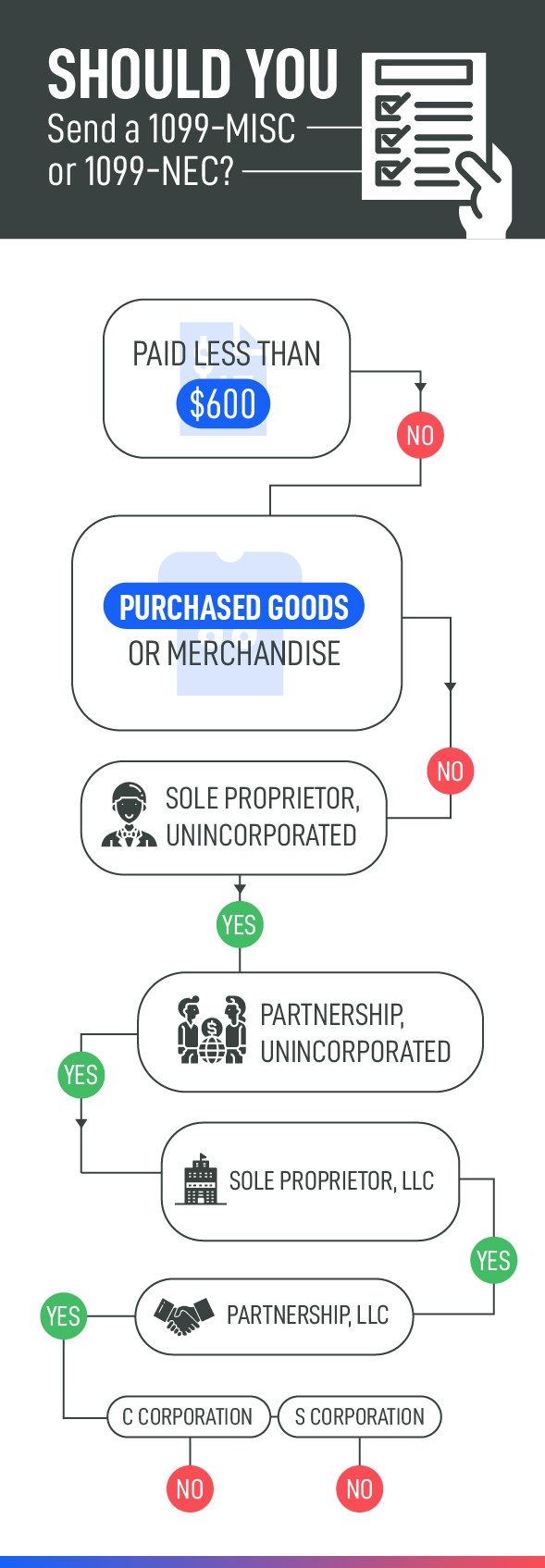

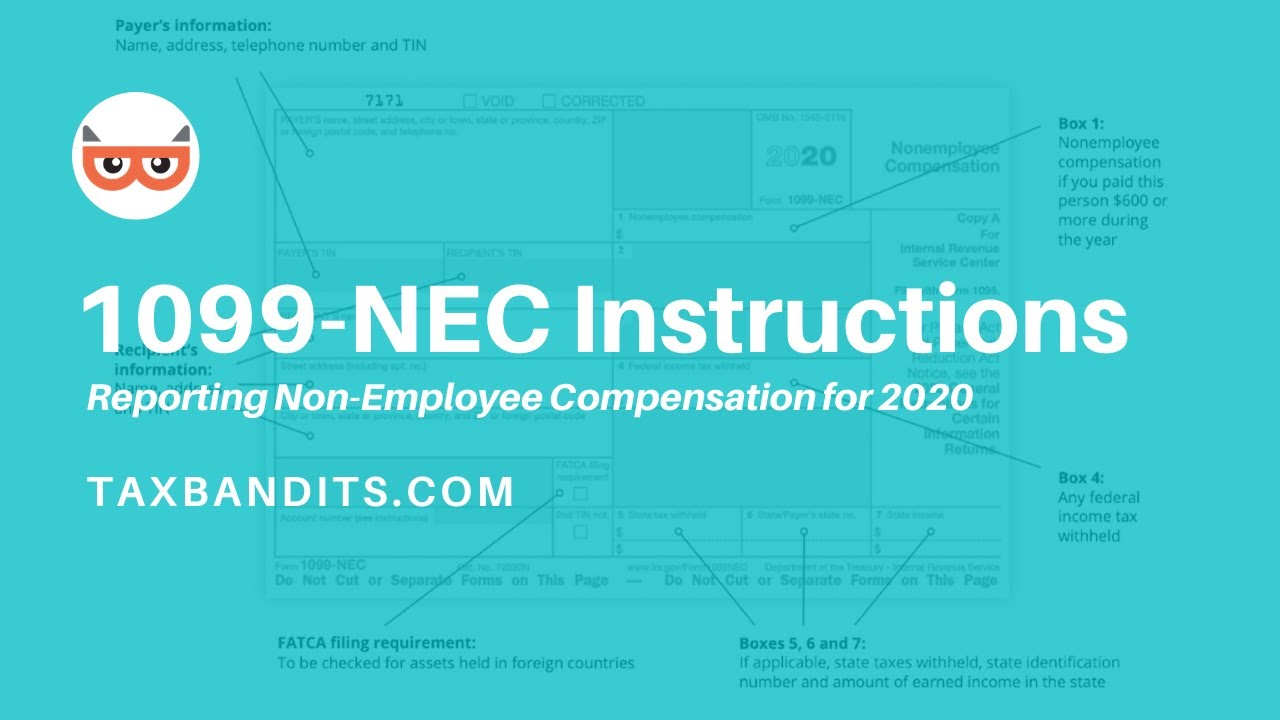

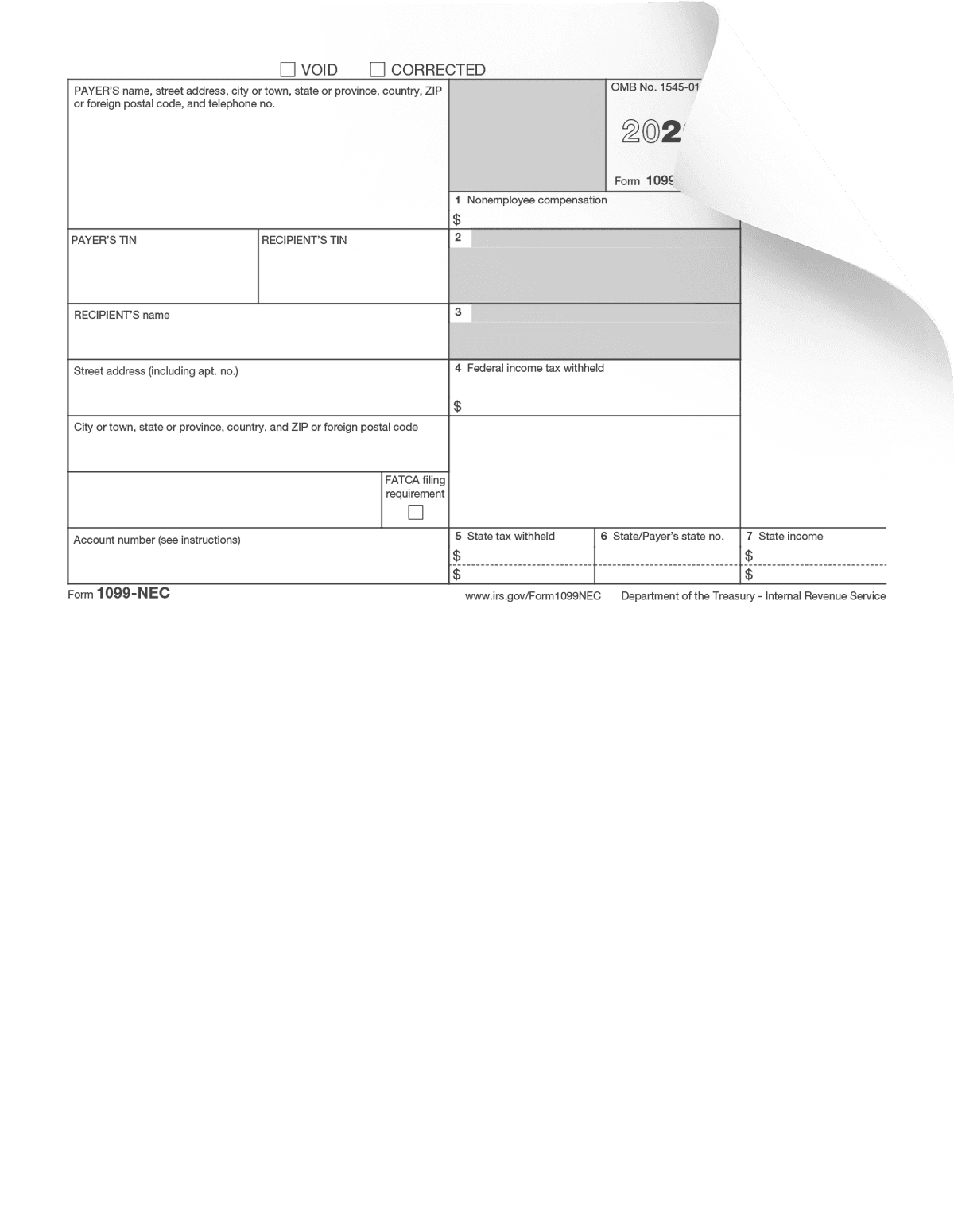

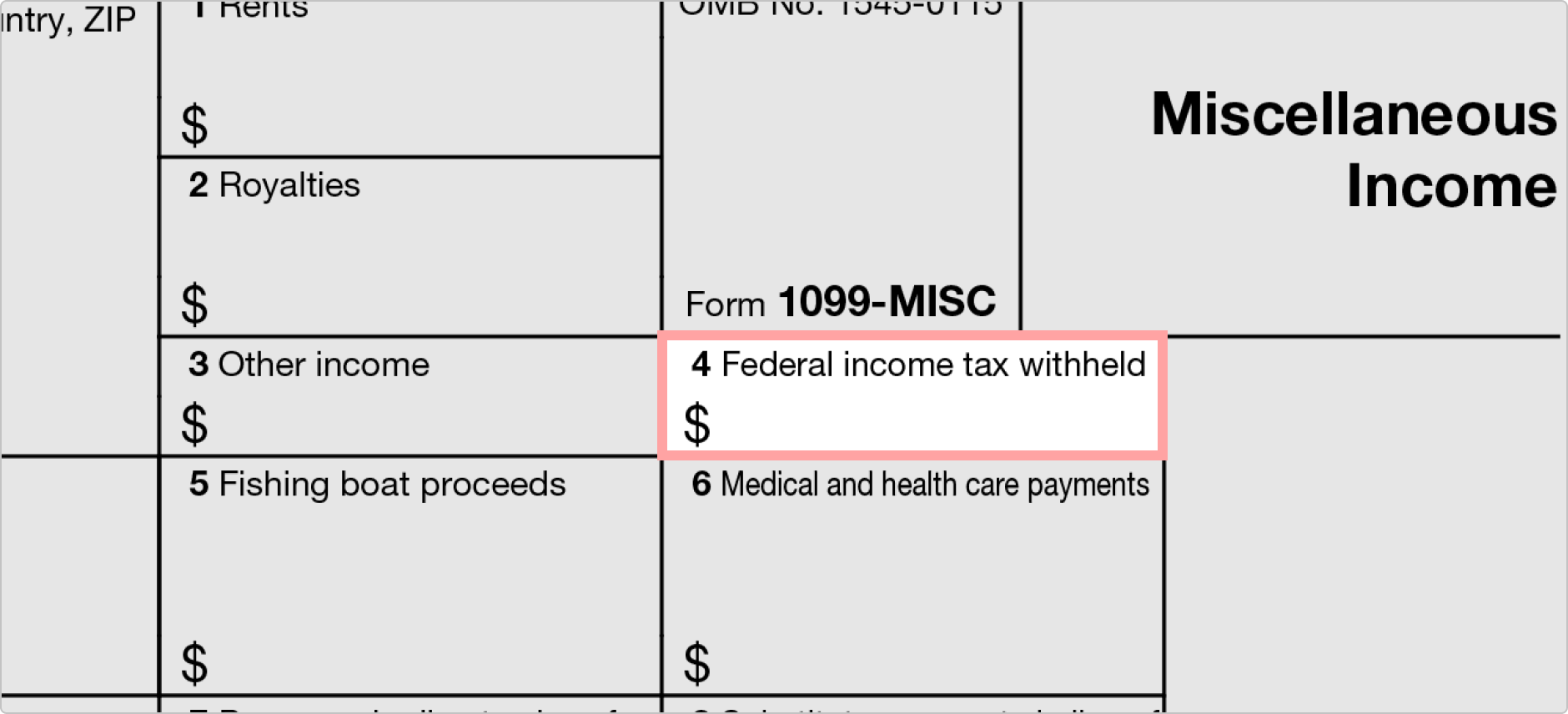

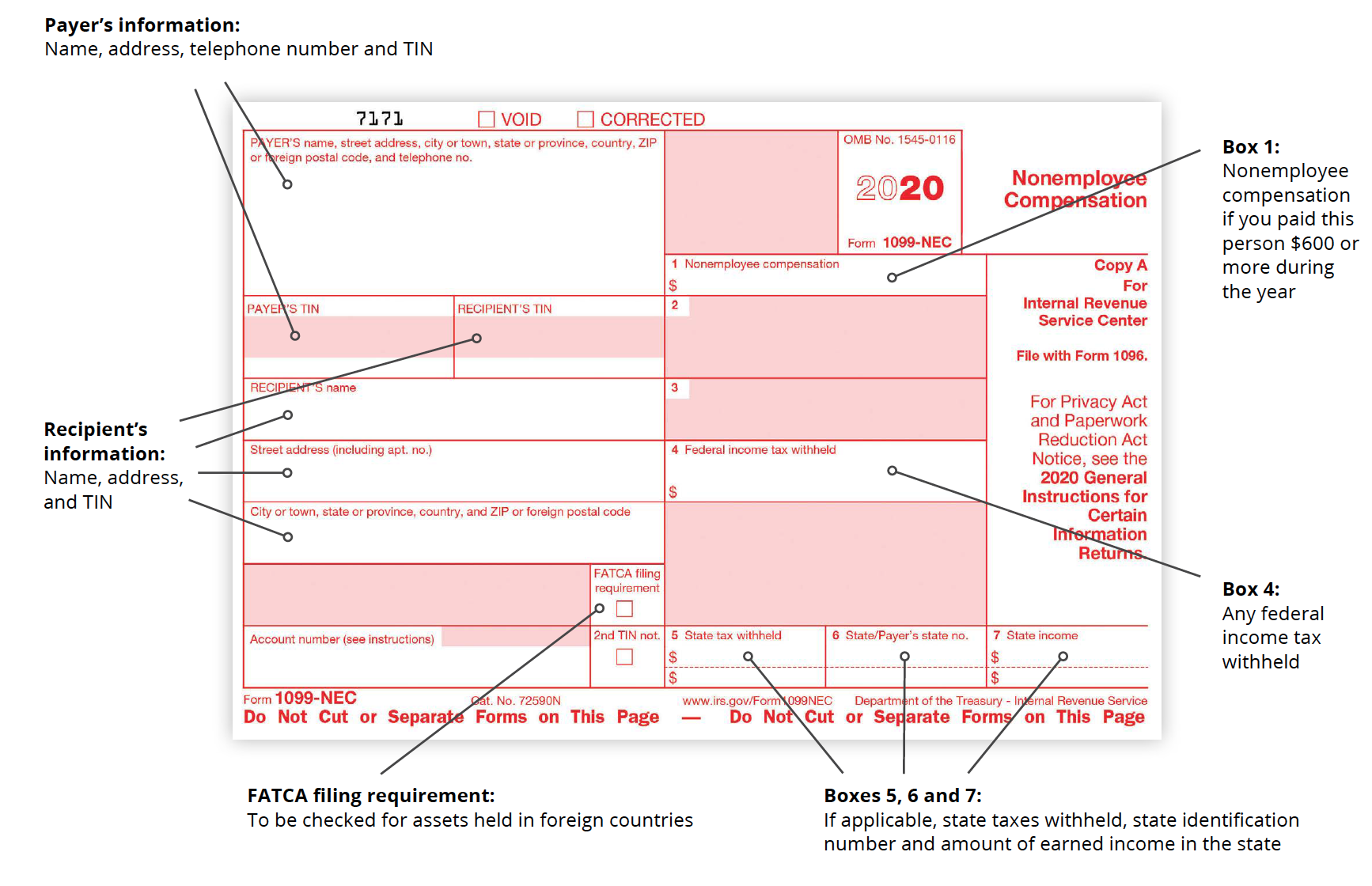

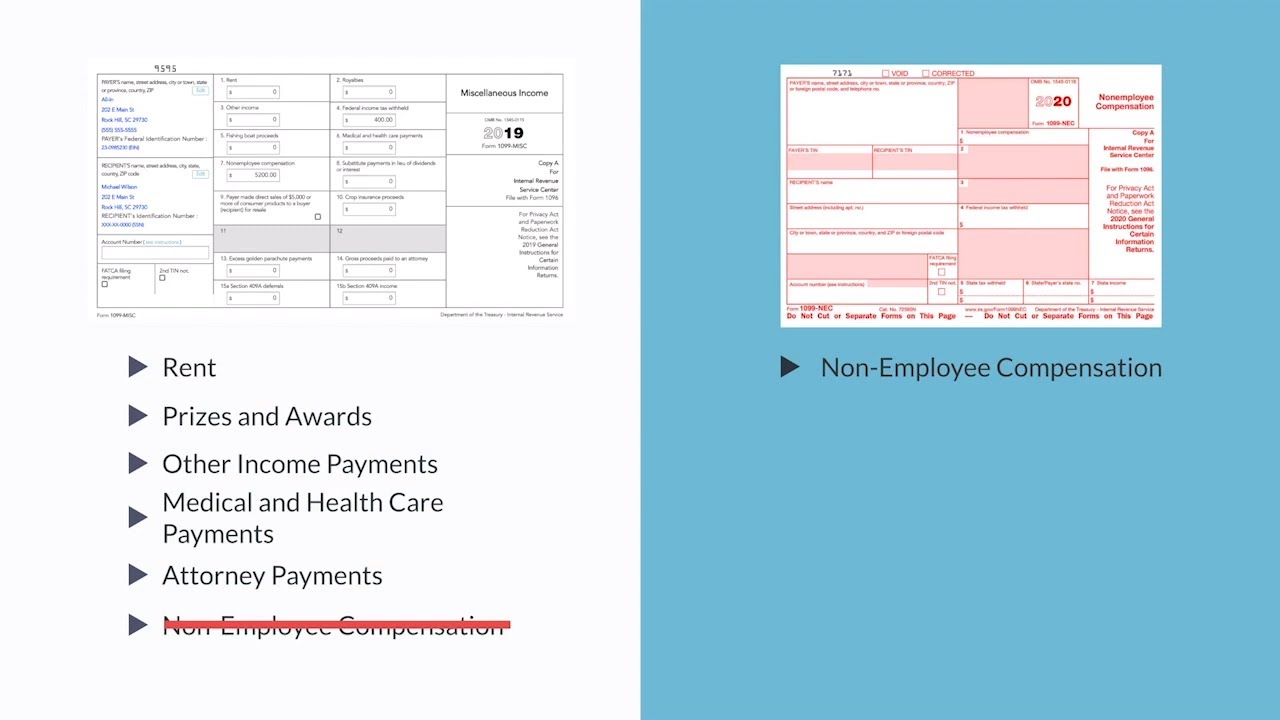

The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)Discover optimized, integrated, proven systems for your business Home;How to Submit Your 1099 Form to IRS in Each individual or business with earnings starting from $10 receive the 1099 form to declare their annual income You must pran earnings report and pay taxes whether you have received the request or not You should pay your income fee only once a year on or around April 15

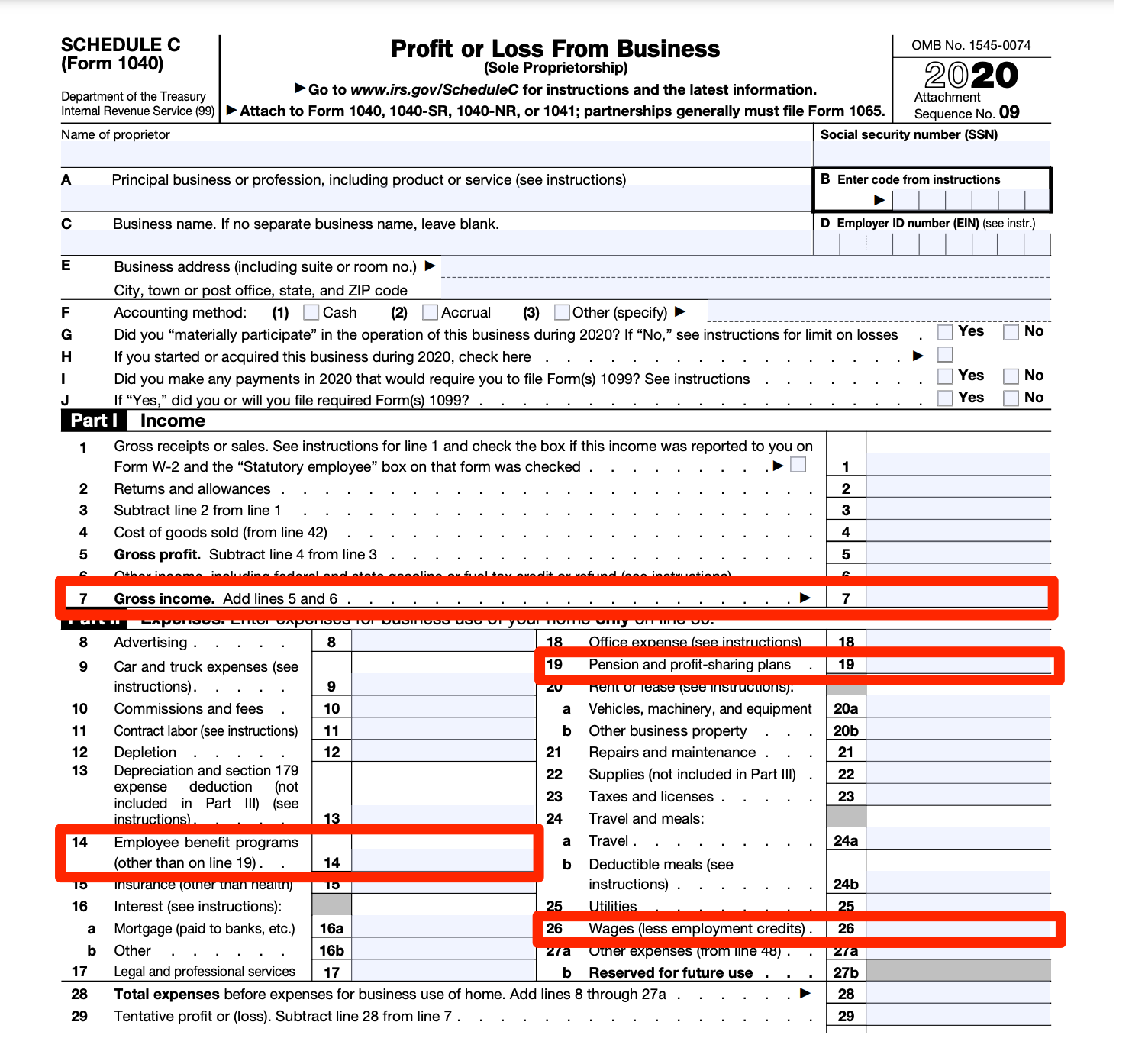

For the 1099 MISC Form Filing process, go through our lines 1099 MISC Form for an Independent Contractor to whom you paid $600 or more amount START 1099 MISC When you paid more than or equal to 600$ to the non–employee during the year?Independent contractors must report the selfemployment income information that they receive from a Form 1099 This makes a schedule C part of their filing process as well Because employers don't have to withhold federal income taxes, state taxes, etc for independent contractors It can be significantly cheaper to hire a freelancer rather than a fulltime employeeGet Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee Compens

Irs 1099 Misc Form 1099 Misc Free 1099 Misc Form 1099 Misc Form By Form1099 Issuu

1

1099 Form Independent Contractor Pdf / E File Form 1099 With Your 21 Online Tax Return If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes All contractors need to show their income for the year You can import it to your word processing software or simply print it Without a completed 1099 form, filling out a For independent contractors or selfemployed individuals filing with 1099 Form, it used to make more sense to itemize deductions because expenses could be more than $6,350 But now more 1099Form workers are picking the Standard Deduction Keep this mind as you track your mileage and expenses while doing food delivery with your car, 4 The employer may have forgotten to send a 1099 Tax Form NEC for the amount paid to you Most likely, the payer paid you less than $600, then no 1099 Form Independent Contractor must file it If recipients get payments from several organizations, recipients may or may not have a Form 1099 NEC

How Can I Get A Copy Of My Tax Form Support Center

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

Importance of issuing 1099 MISC Form to independent contractors 1099 MISC Form is a simple statement that shows your personal information, address, Tax Identification Numbers of both you and your client Every business individual must issue a IRS 1099 MISC Tax Form for the payments made in a tax year to the contractor As we know, the form includes how much money you'veIt's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter If you pay too little in estimated taxes the IRS may subject you to 1099NEC This form, retired in the 1980's and reintroduced for the tax season, is likely to be one of the mostused forms going forward The United States is seeing a massive surge in folks working as independent contractors This means fewer businesses are hiring employees, instead choosing to outsource this work to contractors The 1099NEC is designed

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

1099 Misc Form Fillable Printable Download Free Instructions

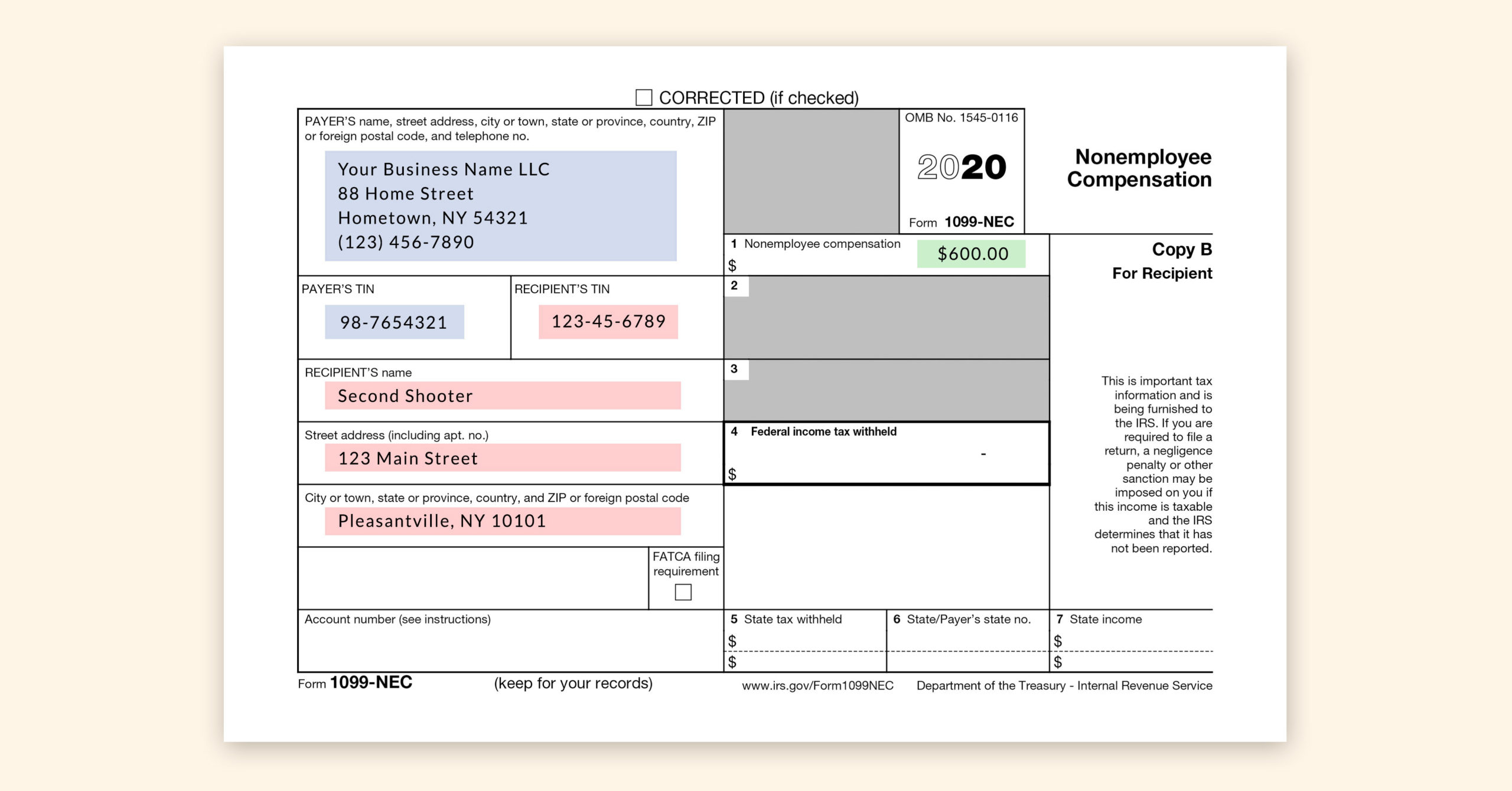

Yes, they can It's possible that an individual is employed at a company but still performs work as an independent contractor within one fiscal year There are Form 1099NEC Beginning with tax year , Form 1099NEC replaces the previously used Form 1099MISC for independent contractors This form is used by companies to report payments made in the course of a trade or business to others for services It must be filed by any company that pays an independent contractor $600 or more during the year —one of the most tumultuous years any of us have ever experienced—is mercifully ending soon Unfortunately for independent contractors and gig economy workers, that means the beginning of tax season As an independent contractor, you most likely know your that taxes are calculated differently than traditional employers Instead of the W2 (the tax form used

1099 Misc Form Fillable Printable Download Free Instructions

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

The IRS has extensive guidance on who must send and receive a 1099MISC By January 31 of each year, you must provide a copy of the 1099MISC form to the income recipient – that is, to the1099 Form For Independent Contractors kodyjohnston Templates No Comments 21 posts related to 1099 Form For Independent Contractors 1099 Form For Independent Contractors 18 Irs 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors Printable 1099 Forms For Independent Contractors Form For 1099 Contractors How To Fill Out A 1099 Form1099 Form Independent Contractor – In the event you have carried out any freelance work or other impartial contractor function, you may get a 1099 Form from businesses that you have labored with more than the years (most probably a 1099MISC) 1099MISC Forms report back to the Internal Revenue Service, exactly just how much a business has paid to you previously year

Hey My Irs Form 1099 Is Wrong Maybe Intentionally

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Latest Articles 1099 MISC Instructions Handling your Form 1099 like a champ may seem pretty easy at While businesses have traditionally reported their payments to independent contractors on a Form 1099MISC, beginning in those businesses must report more than $600 in payments to most nonemployees for business services on the new Form 1099NEC Businesses are also required to issue the Form 1099NEC to report payments for legal servicesA list of job recommendations for the search 1099 form independent contractor is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested

What Is Form 1099 Nec Who Uses It What To Include More

Instant Form 1099 Generator Create 1099 Easily Form Pros

Form 1099 Step by Step Instructions on how to efile the Form 1099 is Taxable Income on your or 21 Tax Return May 17 is Due Date Form 1099 Reported Online to the IRS by the Payer or Issuer Issue a Form 1099 to a Payee, Contractor or the IRS Detailed Instructions on How to Send it to the Recipient and to File with the IRS The form is sent to workers and reported to the IRS by the end of January of the following year 1099NEC forms for the tax year must be sent by Can I Be Both a Sole Proprietor and an Independent Contractor?The independent contractor is an individual person who works for someone else, provides services and not an employee The person receives a 1099 NEC Form at the end of the year for receiving $600 or more for the work done as a contractor No payroll taxes are deducted for the payments to the contractors

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

For that year, you need to File a 1099 MISC Tax Form for your recipient who takes payment from you for their service An Independent Contractor If you're a business owner, you must send the 1099 Form to all the independent contractors that have received at least $600 from you in services, prizes, or other income types;1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayer

Changes To 1099s In Altruic Advisors

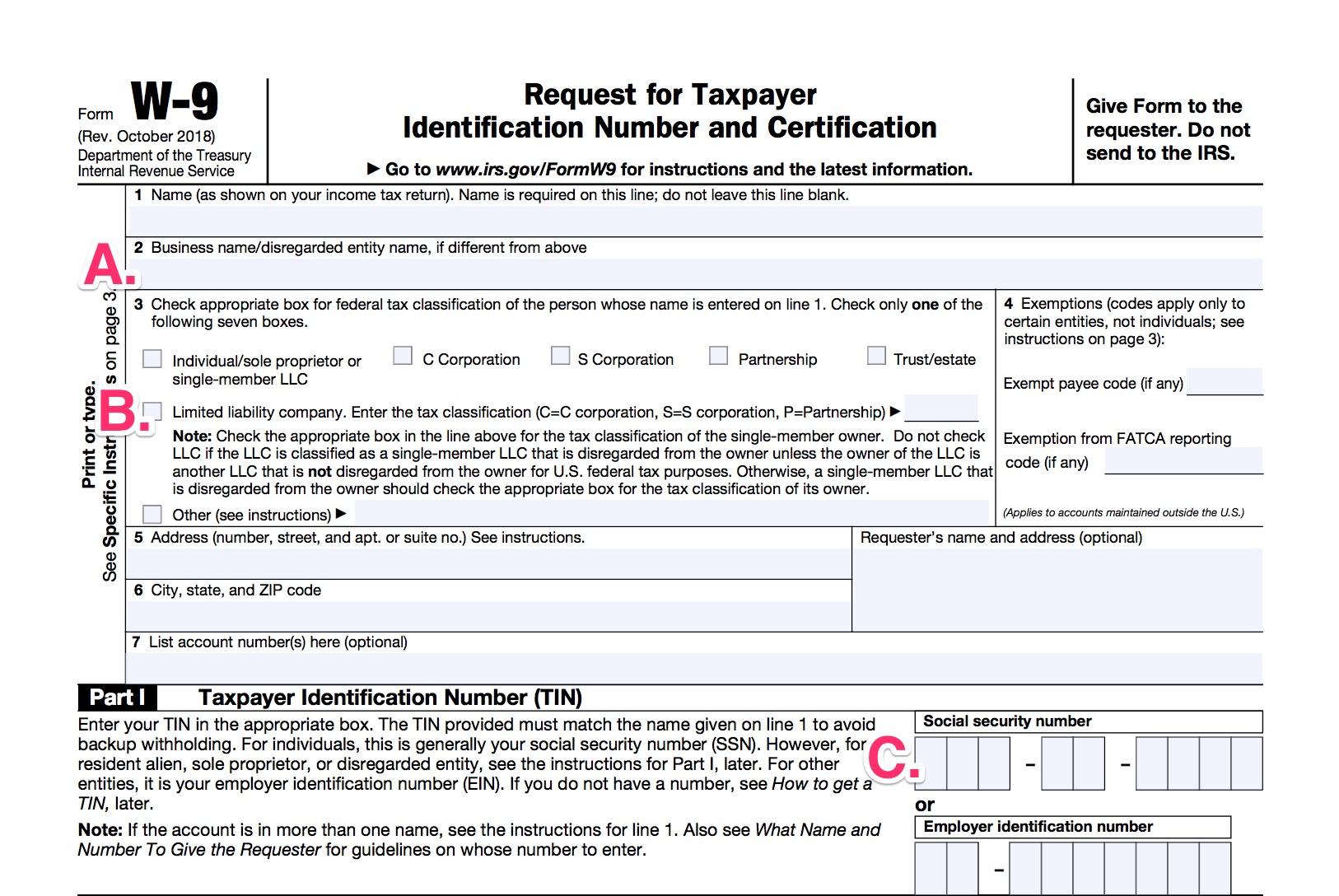

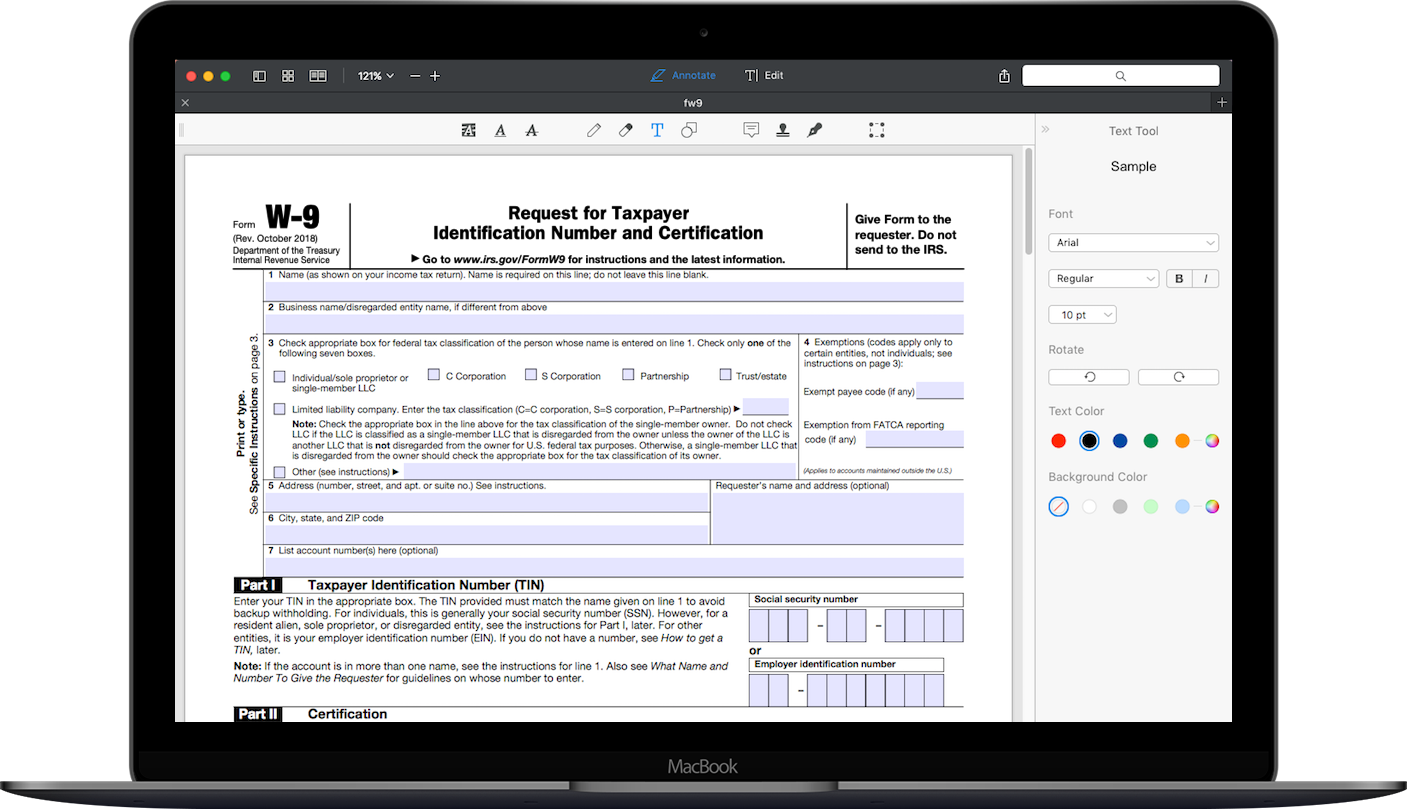

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Prior to the 1099 form independent contractor change this past year, the Form 1099NEC was last used in 19 Businesses are now required to use the form to report payments under the following circumstances the payment is made to someone who is not an employee, the payment total is reaches or exceeds $600 for the entire year, the payment is made for services in theA 1099 contractor is a person who works independently but not for an After that, your business is responsible for filing a Form 1099NEC (nonemployee compensation) for every independent contractor you work with Previously, the 1099MISC was used to report freelance and independent contractor expenses, but as of the tax year , the 1099NEC is the one you need

Www Idmsinc Com Pdf 1099 Nec Pdf

1099 Misc Form Copy B Recipient Zbp Forms

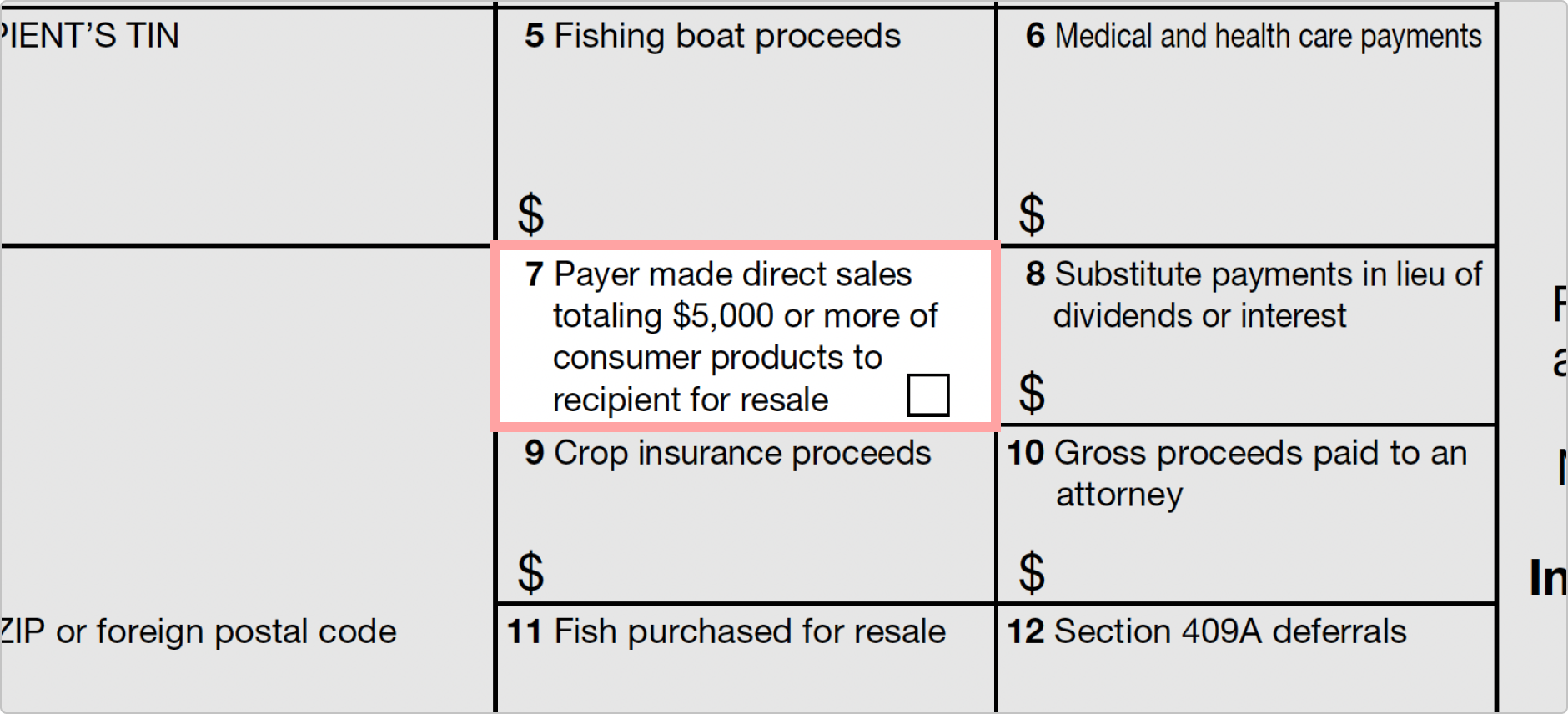

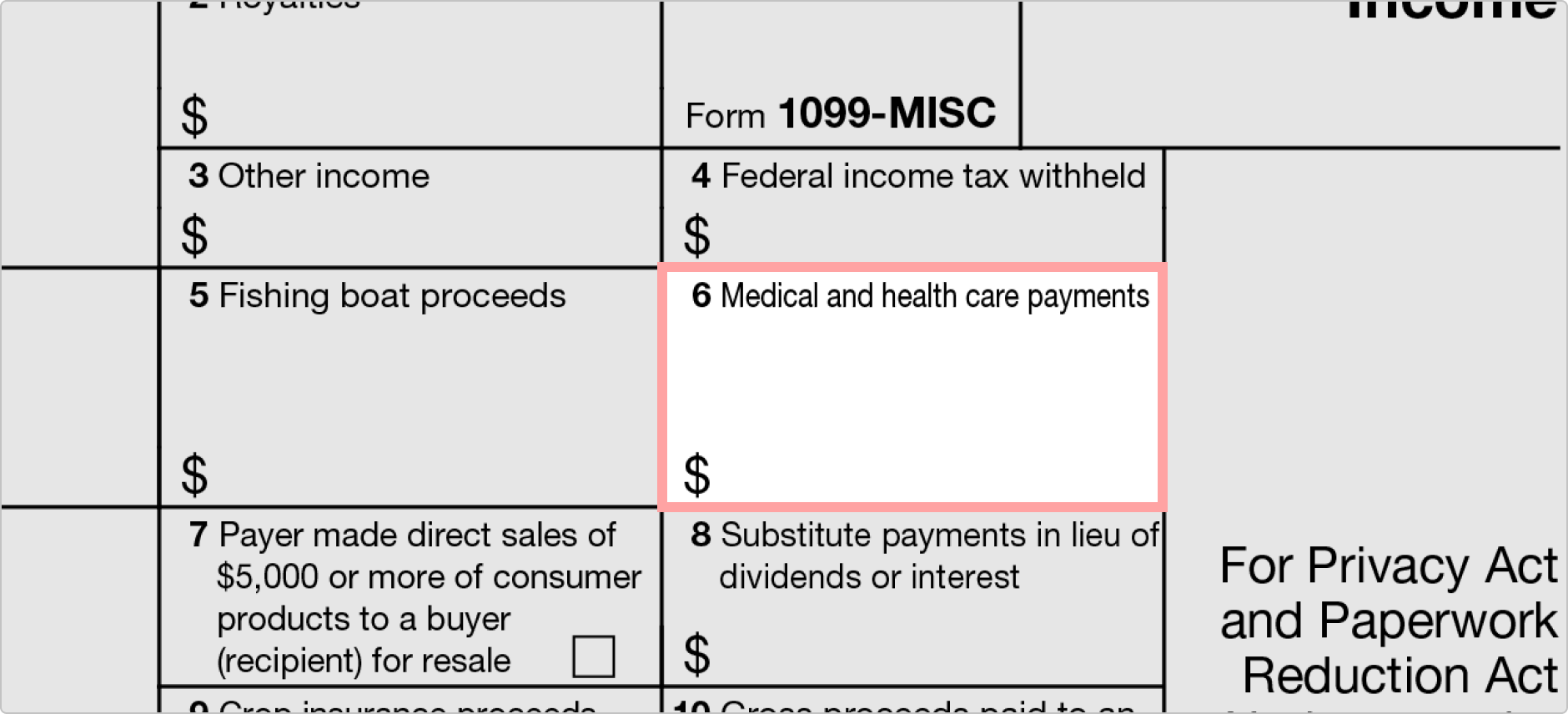

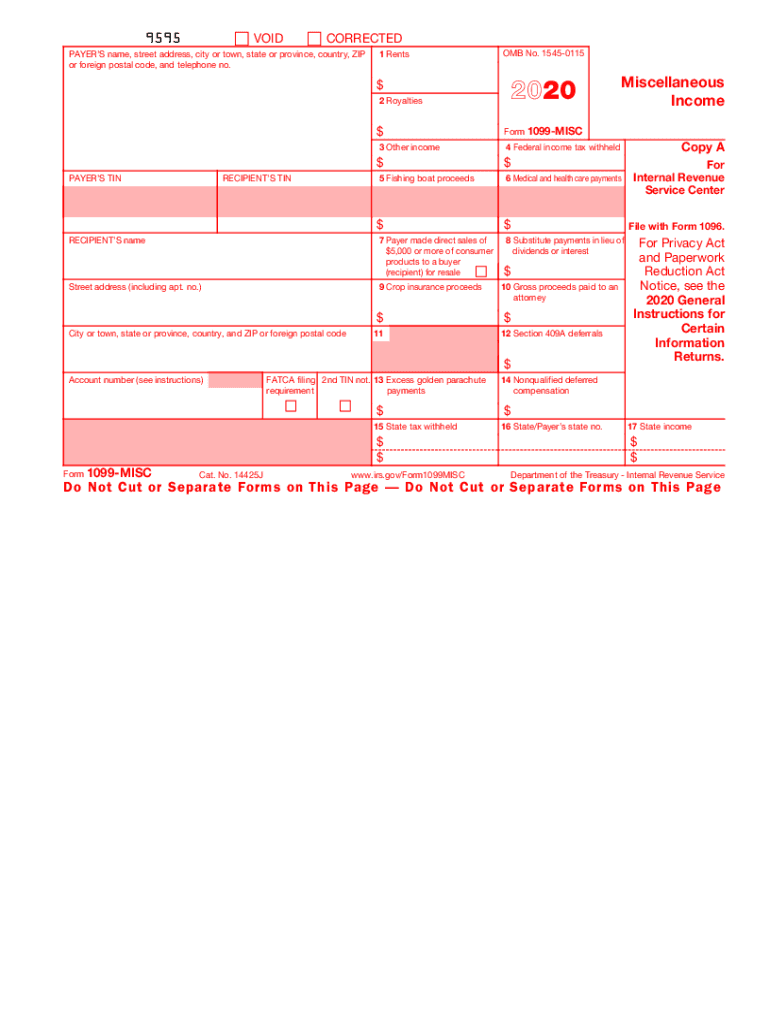

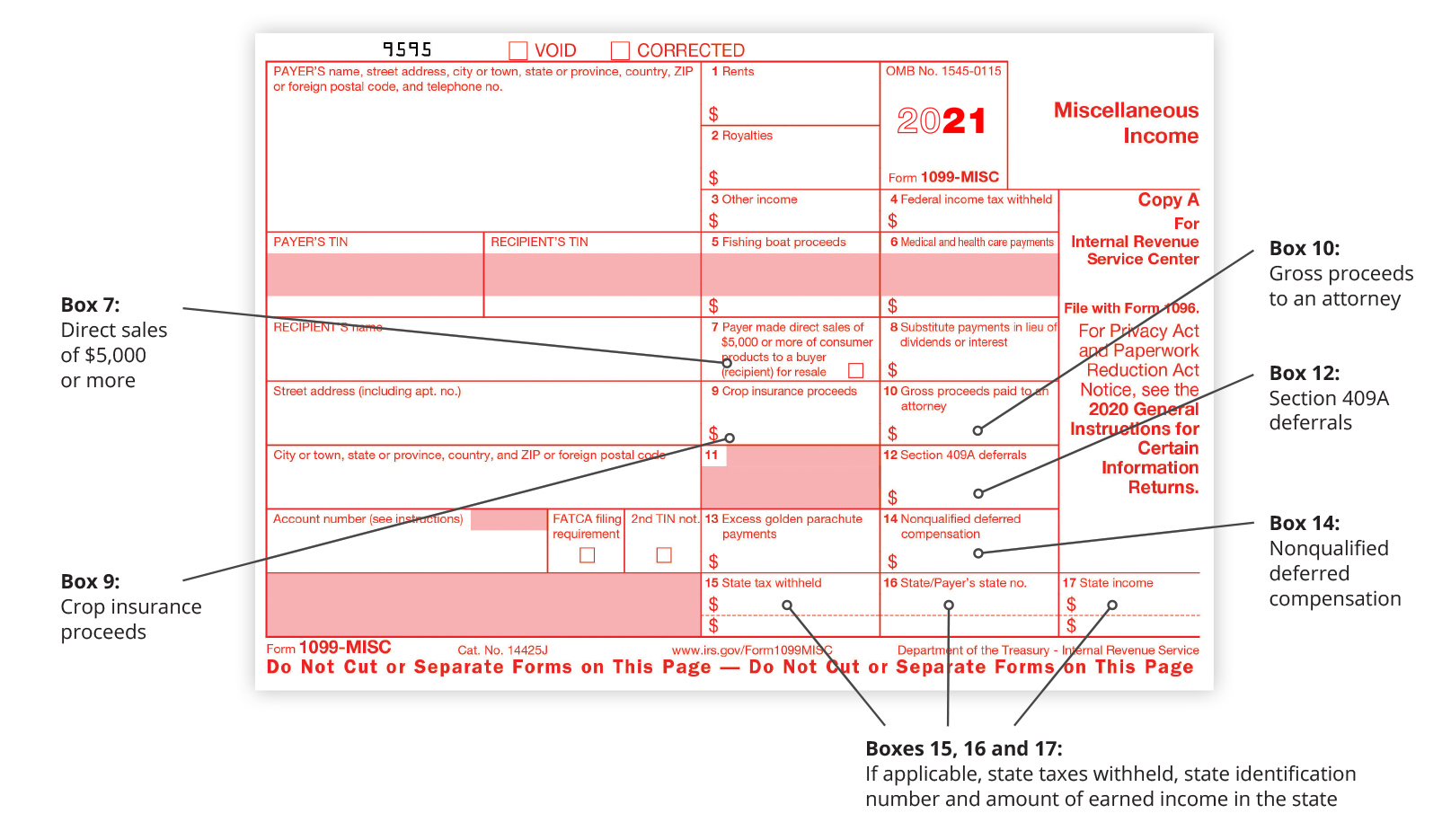

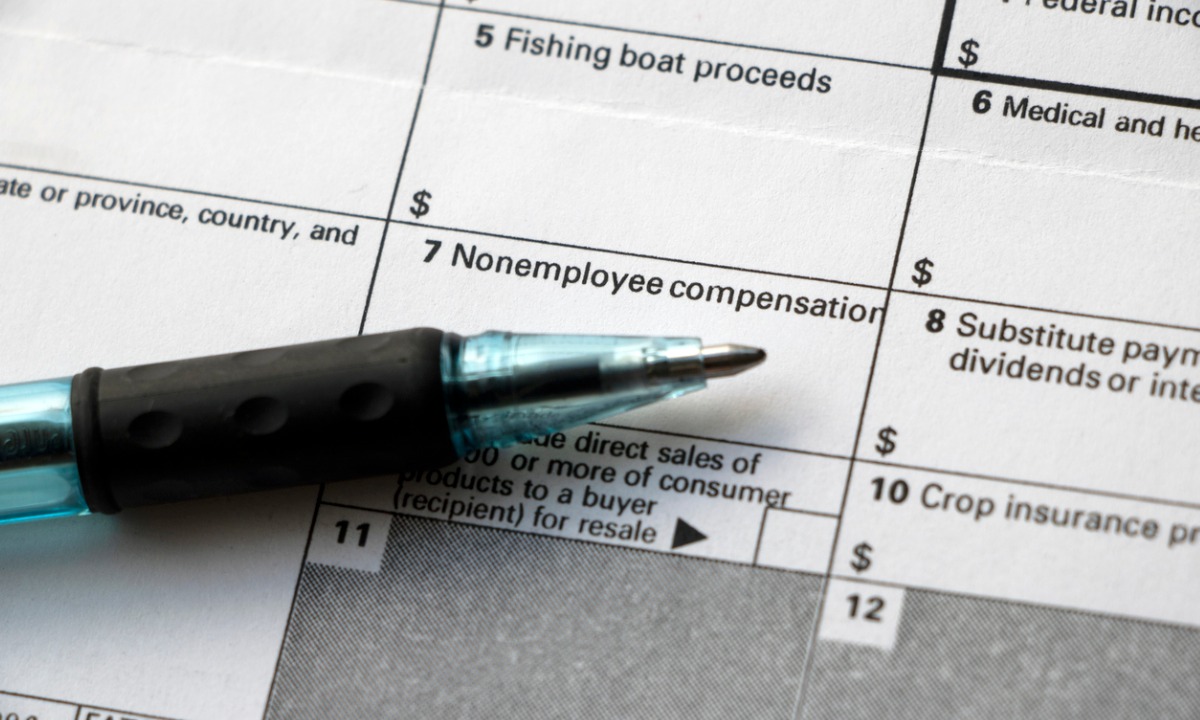

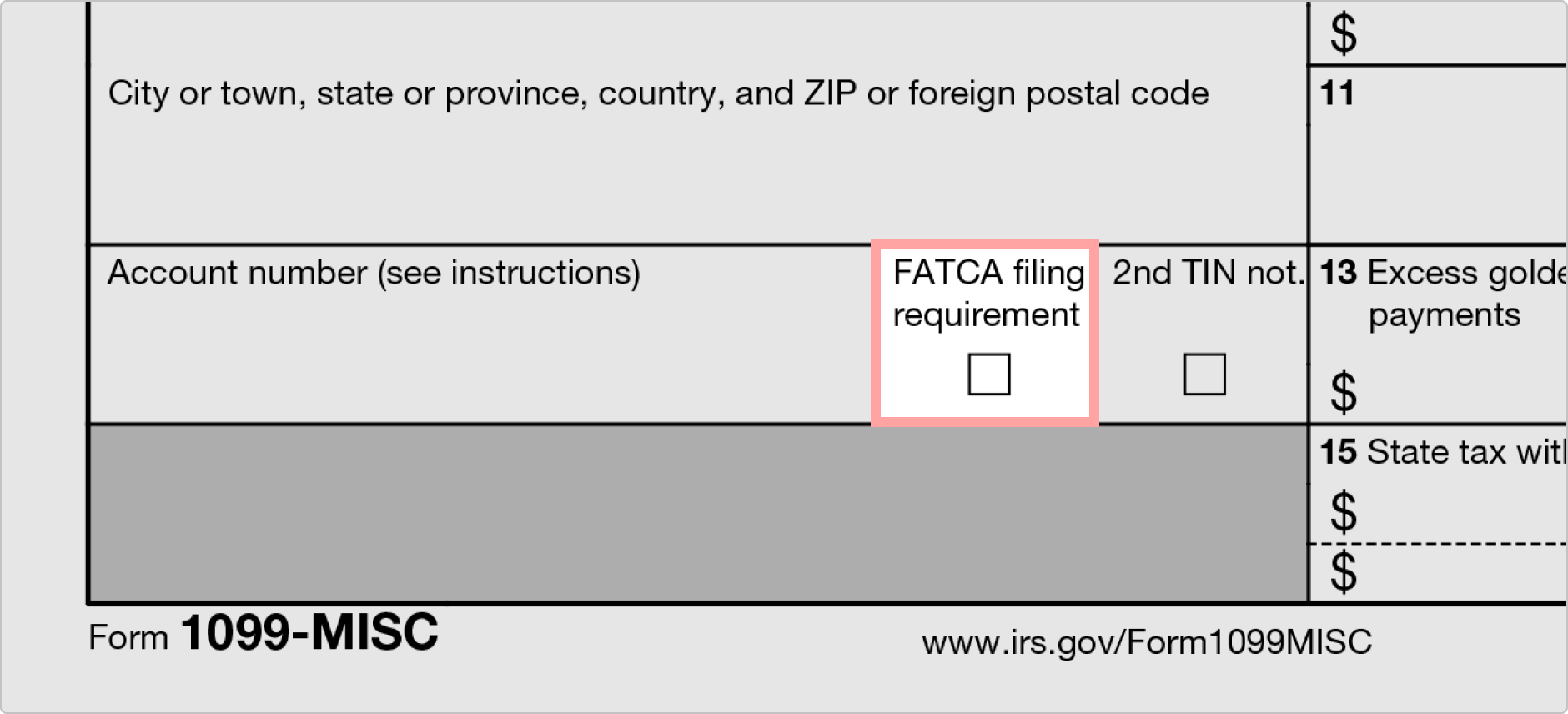

Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade The independent contractors need1099 MISC form reports the money paid to the independent contractors in a year It includes some personal details of the contractor like name, addresses along with either Social Security Number or Employer Identification Number Employers need to send the 1099 MISC form to the contractors by 31 st Jan, and to the IRS by the last date Form 1099MISC has been redesigned, and employers will now report all nonemployee compensation paid to independent contractors on Form 1099NEC Although taxpayers will no longer report nonemployee compensation in Box 7 of Form 1099MISC, taxpayers must still use the form to report other miscellaneous payments The changes are effective beginning with the tax year Form 1099

What Are Information Returns Irs 1099 Tax Form Types Variants

Irs Tax Form 1099 Misc Instructions For Small Businesses Contractors

Or have received attorneyrelated income;Starting with the year tax filing, businesses that pay $600 or more to an independent contractor are required to fill out a new form, the 1099NEC (Nonemployee Compensation) In previous years sending independent contractors' payment information to the IRS was accomplished by the 1099MISC A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company They set their own hours, use their own tools and methods, set their own salary, and

Swart Baumruk Company Llp

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Form 1099NEC Note Beginning with Tax Year , you must use Form 1099NEC, Nonemployee Compensation, to report payments of nonemployee compensation (NEC) previously reported in box 7 on Form 1099MISC The separate instructions for filers/issuers for Form 1099NEC are available in the Instructions for Forms 1099MISC and 1099NECForm 1099 MISC Vs 1099 NEC Form in In the prior year, every business individual used 1099 MISC Form to report independent contractor payments along with other miscellaneous income Beginning with tax year, the IRS brought back Form 1099 NEC to report nonemployee compensation Form 1099 NEC solely used to report independent The primary tax form received by an independent contractor is Form 1099MISC If you performed work for a person or business as an independent contractor, you will receive this form at the same time that employees receive W2 forms They usually arrive around the end of January following the tax year

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

Fillable 1099 Misc Form Fill Online Download Free Zform

Form W 9 Form Pros

If you work as an independent contractor or are selfemployed it is important to stay up to date on the latest tax changes As we start gearing up for tax season, you may be wondering what has changed for tax year 19 (filed in ) With the passage of the Tax Cuts and Jobs Act, a lot of tax changes were implemented last year, like an increase in the standard deduction andForm1099onlinecom made e file 1099, form 1099 online,1099 online, 1099, 1099 form for , 1099 form, and form 1099 1099 Independent Contractor vs Employee Updated Which is why I created this overview of 1099 independent contractors vs employees, updated for Avoiding Taxes by Paying in Cash There are many ways small business owners pay employees under the table The most popular method is obviously cash The person does the work and the

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

The 1099 Form What You Need To Know About Filing

We'll let you know about Form 1099 types of independent contractors We have provided you the detailed information about different types of independent contractors who receive a 1099 Form in the tax year Get Start For Free When do you consider an individual as 1099 contractor? Generally, if you're an independent contractor you're considered selfemployed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) Most selfemployed individuals will need to pay selfemployment tax (comprised of social security and Medicare taxes) if their income (net earnings

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Misc For Independent Consultants 6 Step Guide

What Is A W 2 Form Turbotax Tax Tips Videos

Major Changes To File Form 1099 Misc Box 7 In

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

How To File Your Independent Contractor Returns Guide

Tax Form 1099 Misc Fillable 1099 Misc Fillable 1099 Misc Template By Form1099 Issuu

Www Irs Gov Pub Irs Pdf I1099msc Pdf

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

1099 Workers Vs W 2 Employees In California A Legal Guide 21

100 Pack Copy A Only Blue Summit Supplies 1099 Nec Copy A Forms 50 Sheets

Tax Update For Owner Operators And Fleet Owners Mission Financial

1099 Nec Vs Misc How To Prepare For Next Week S New Irs Deadline

E File Form 1099 Nec For Tax Year File 1099 Nec Online

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

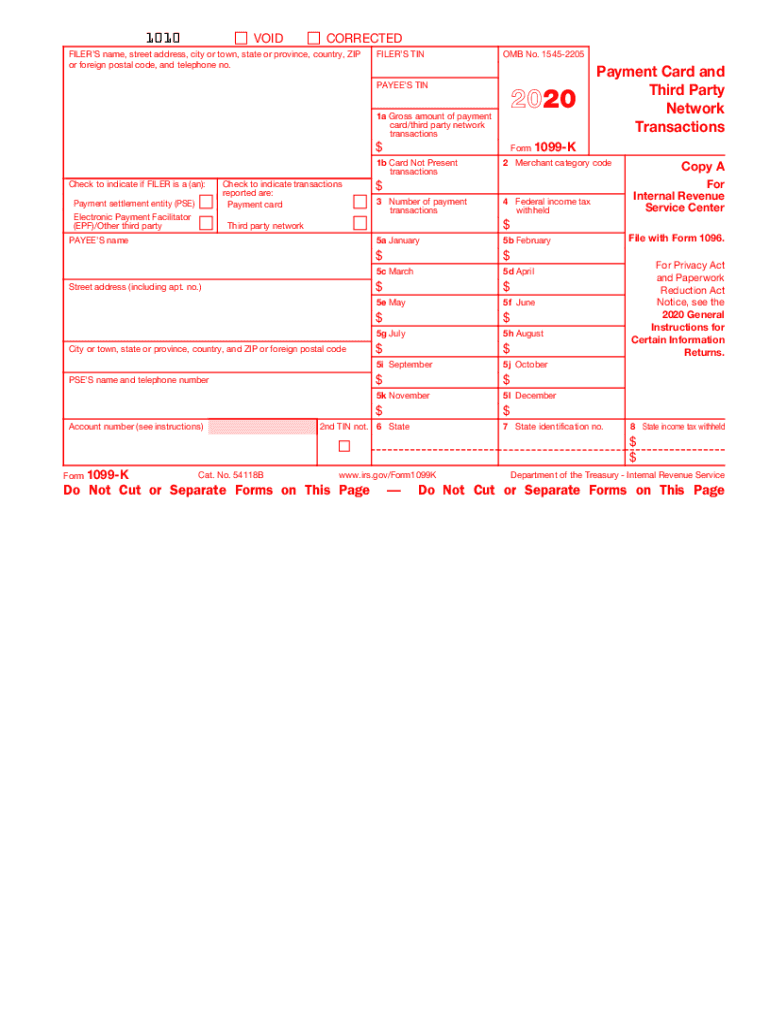

Form 1099 K Payment Card And Third Party Network Transactions Definition

How To File Form 1099 Nec For The Tax Year In 21 Business Rules Federal Income Tax Tax Forms

Irs Form 1099 K Paypal 1099 Form 21 Printable

New Irs Rules For Reporting Non Employee Compensation With Form 1099 Nec Complyright

Top 25 1099 Deductions For Independent Contractors

1099 Workers Vs W 2 Employees In California A Legal Guide 21

1

3

Independent Contractor Taxes Guide 21

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

What Is Form 1099 Nec For Nonemployee Compensation

1099 Nec Form 21 1099 Forms Zrivo

Confused About The New 1099 Nec Today Cfo

Free California Independent Contractor Agreement Word Pdf Eforms

When Do You Need To File A 1099 Misc Or 1099 Nec Tl Dr Accounting

1099 Form 1099 Forms Taxuni

Form 1099 Misc Instructions

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

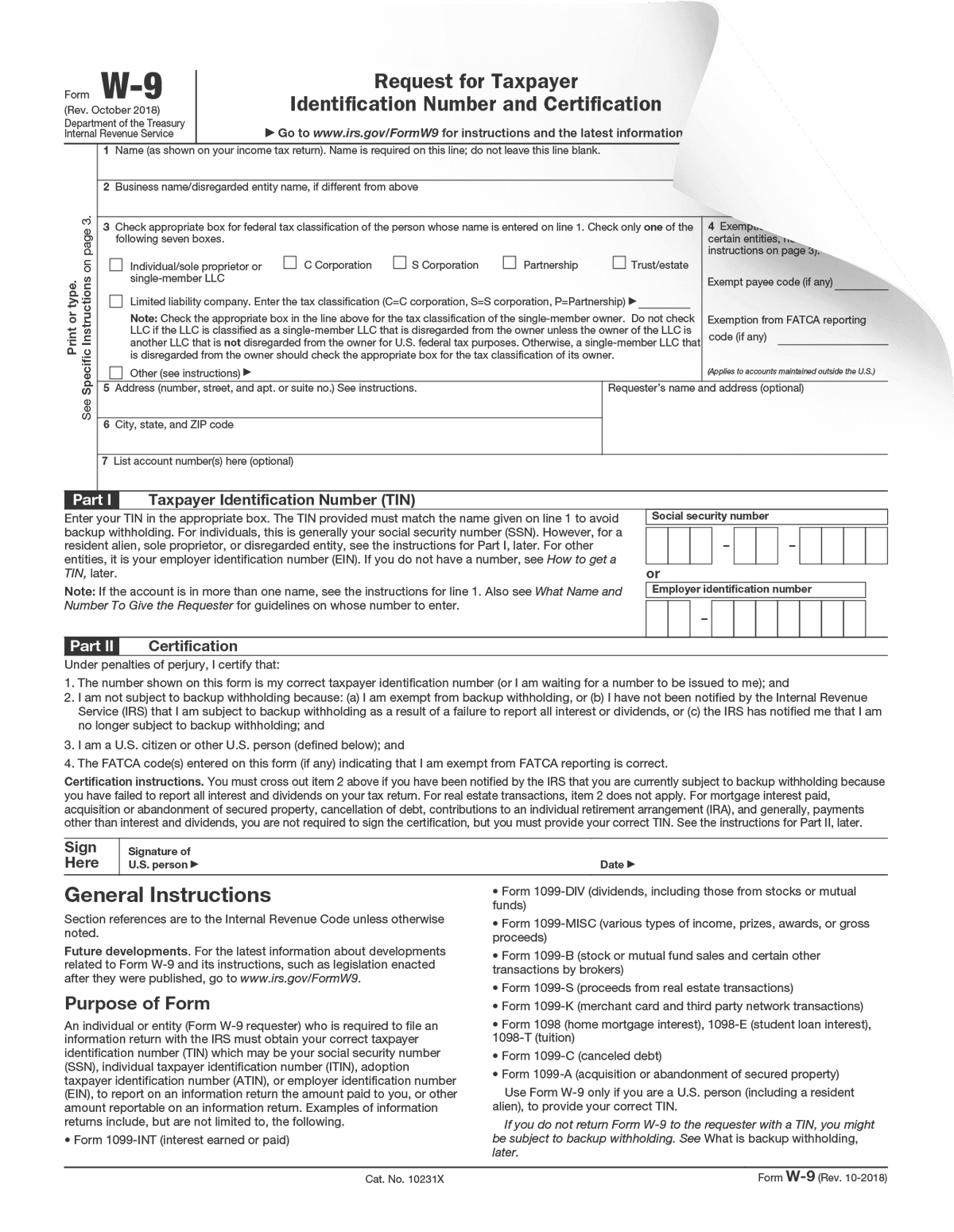

What Is A W 9 Form Robinhood

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

It S Irs 1099 Time Beware New Gig Form 1099 Nec

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Everything You Need To Know About The New Irs 1099 Nec Form

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

What Is Form 1099 Nec For Nonemployee Compensation

Form 1099 Misc Vs Form 1099 Nec How Are They Different

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Nec Form Pros

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

1

The Irs Restores Form 1099 Nec For Year End Reporting Sikich Llp

How To Fill Out Irs Form W 9 21 Pdf Expert

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

New Form 1099 Reporting Requirements For Atkg Llp

1099 Nec

Reporting Income For Grubhub Doordash Postmates Uber Eats Contractors

What Is Form 1099 Nec Who Uses It What To Include More

What Is The 1099 Form For Small Businesses A Quick Guide

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

Form 1099 Nec Instructions And Tax Reporting Guide

Amazon Com 1099 Misc Forms 21 4 Part Tax Forms Kit 50 Vendor Kit Of Laser Forms Compatible With Quickbooks And Accounting Software 50 Self Seal Envelopes Included Office Products

Irs 1099 K 21 Fill And Sign Printable Template Online Us Legal Forms

Form 1099 Nec Is New For Here S What You Need To Know

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Trucking Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec

What Is The Difference Between Form 1099 Misc Vs Nec Taxbandits Youtube

Irs Form 1099 Nec And 1099 Misc Rules And Exceptions

Do You Need To Issue A 1099 To Your Vendors Accountingprose

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

1099 Misc Form Fillable Printable Download Free Instructions

What Is A W 9 Form Robinhood

All About Forms 1099 Nec And 1099 K Brightwater Accounting

0 件のコメント:

コメントを投稿