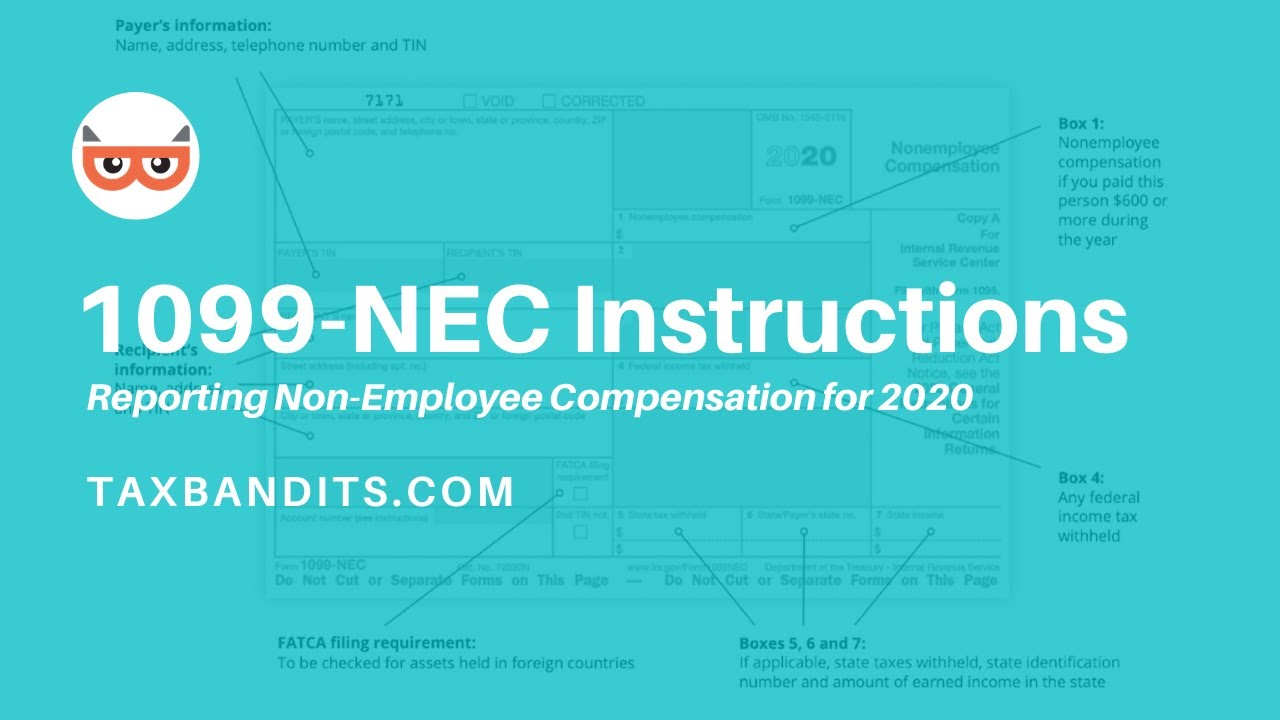

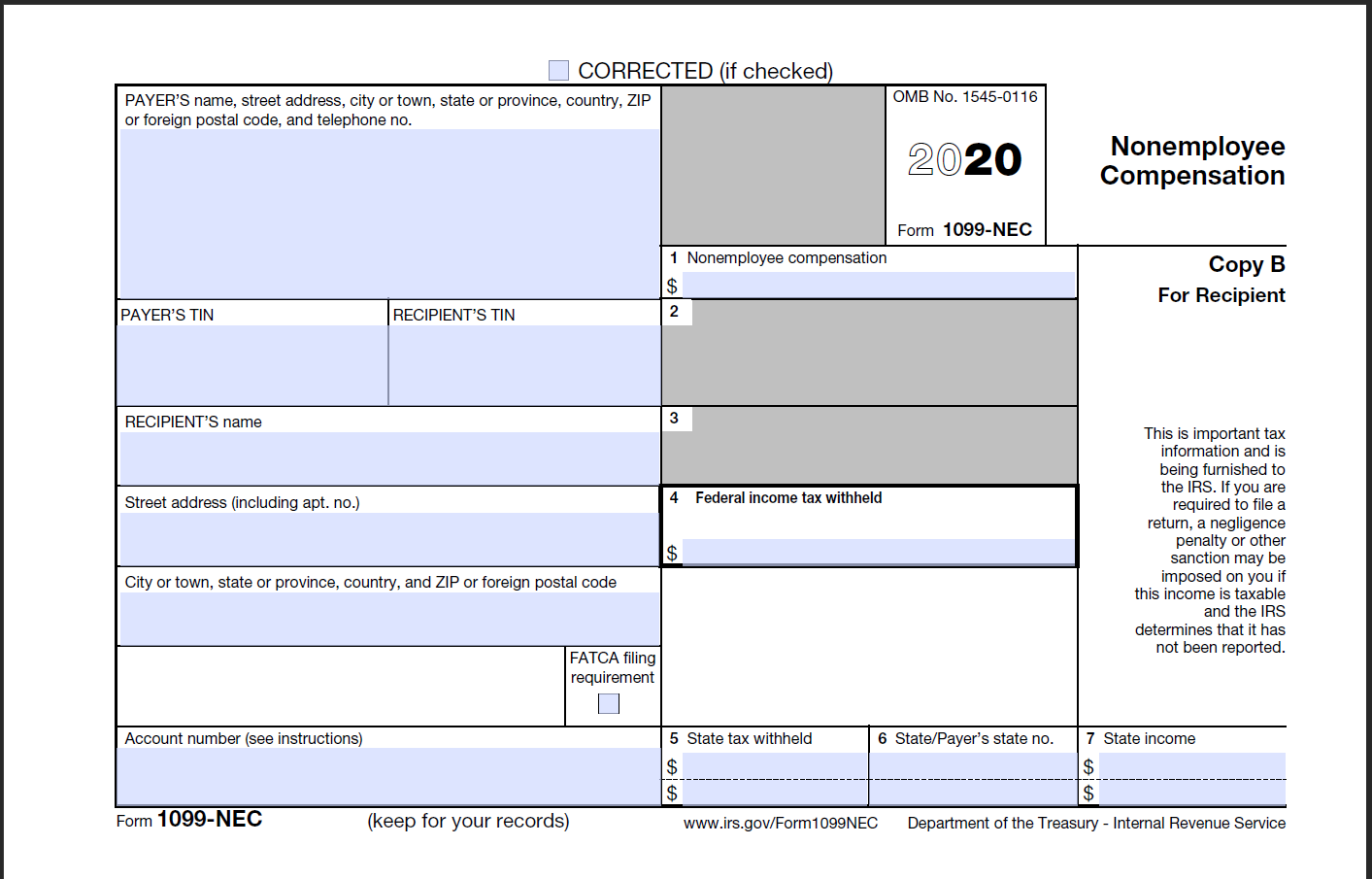

Documenting transactions or income for legal proceedings; A You are required to send the 1099 copies only when you paper file However, when you file 250 or more 1099s, you must file them electronically Regardless of the form volume, efiling is the most preferred method because you can submit multiple 1099s at once without hassle If you still want to paper file 1099s, attach 1096 & G1003 and sendThe threshold for filing "Nonemployee Compensation" forms is $600

Nagforms Laser 1099 Nec Payer State Copy C 100 Pk Neclmc

1099 copy 1

1099 copy 1-Mail in a batch to the State Colorado 1099 Rules EFile CO 1099's File the following forms with the state of Colorado 1099MISC / 1099NEC and 1099R Filing due dates File the state copy of form 1099 with the Colorado taxation agency by Reporting threshold If you file 250 or more 1099 forms with Colorado you must file electronically

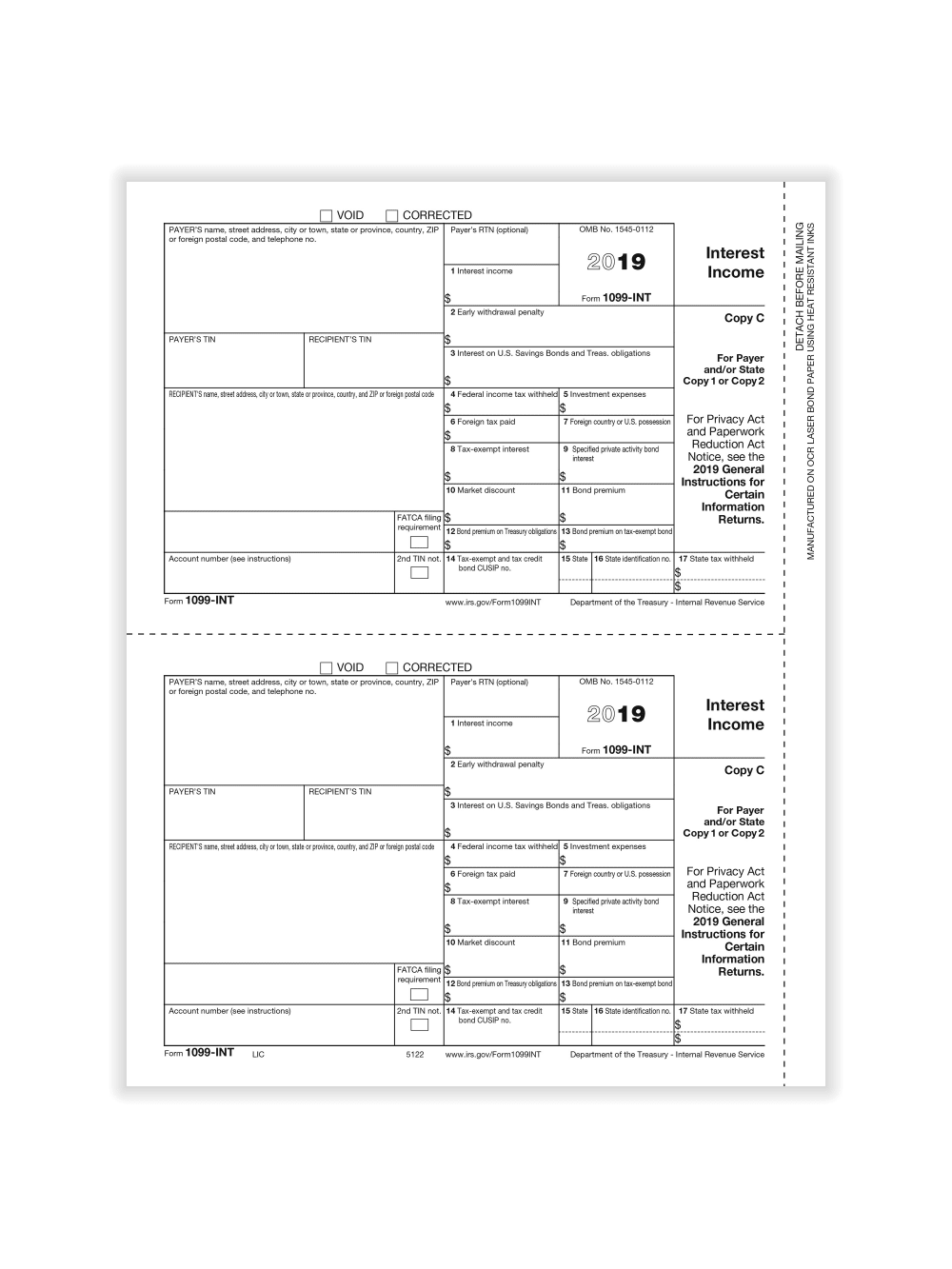

Form 1099 Int Interest Income State Copy 1

People often need copies of their old Forms W2 or 1099 Here are some common reasons Filing back tax returns;Send Copy C form to the state in a batch, and keep Copy 2 for the files Use 1099MISC tax forms to report miscellaneous payments of $600 that are NOT for nonemployee compensationFiling Form 1099R must be mailed to the recipients by January 31 and to the IRS by the last day of February 6 If the custodian files with the IRS electronically, the form is due by March 31 The plan owner, the IRS and the municipal or state tax department (if applicable) all receive a copy

You can file Form 1099NEC electronically, or you can mail it to the IRS Where you mail your completed form depends on your state To eFile Form 1099NEC, use the IRS's FIRE system If you have a cancellation of your debt, you might need to file Copy 1 of your 1099C with your State tax department This cancelled debt might be taxable income The 1099G is used by governmental agencies to report their State income tax refunds and unemployment compensation You might be required to file this form if you claimed a deduction Bachelor's Degree 6,994 satisfied customers As a small business owner, please verify if we should mail As a small business owner, please verify if we should mail both copies of Form 1099Misc (Copy b) and (Copy 1 for State Tax) to the recipient We read more

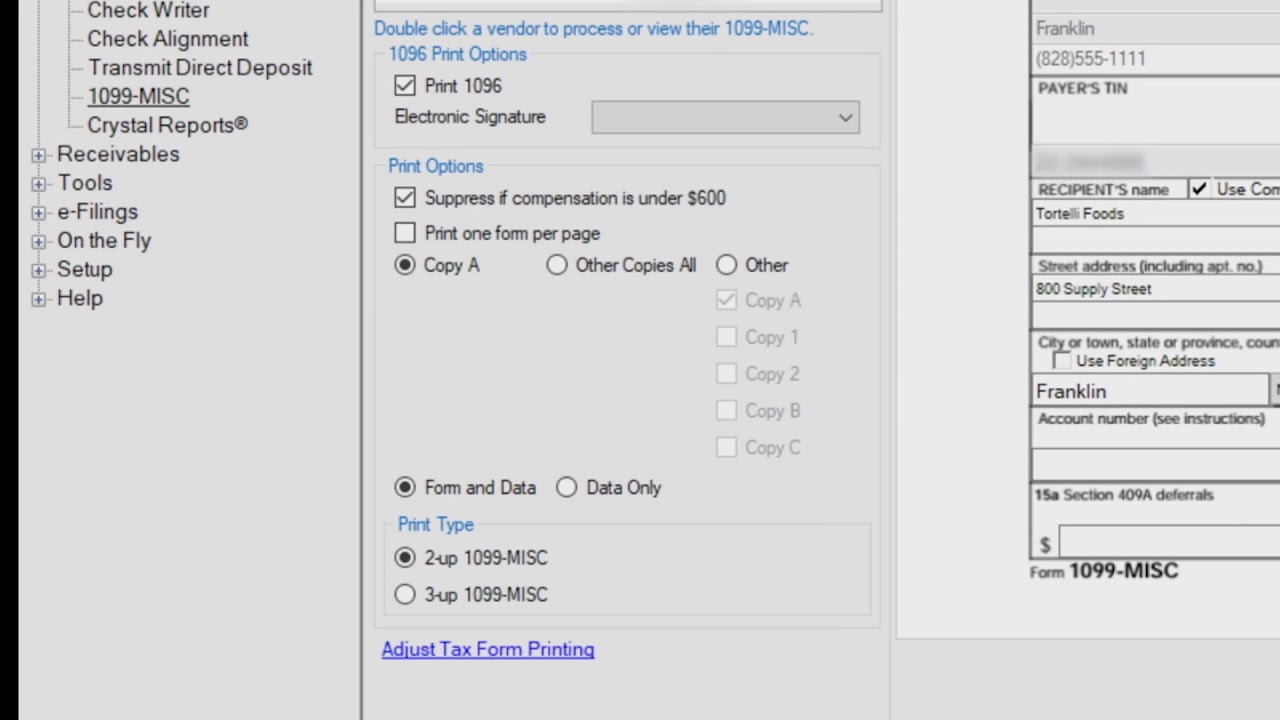

What is a 1099 MISC form Comprising Of?States with additional 1099 filing requirements Starting with tax year , Track1099 will offer a state efile service for $149 per form If you elect not to have us efile to states for you, we will give you the state file for free You would then upload the file to your state's web site 1099R Form Copy D/1 Payer/State Tax Withheld on Distributions Order a quantity equal to the number of recipients you have 2up format;

Boidrec05 Form 1099 Oid Original Issue Discount Copy B Recipient Nelcosolutions Com

Form 1099 Div Dividends And Distributions Irs Copy A

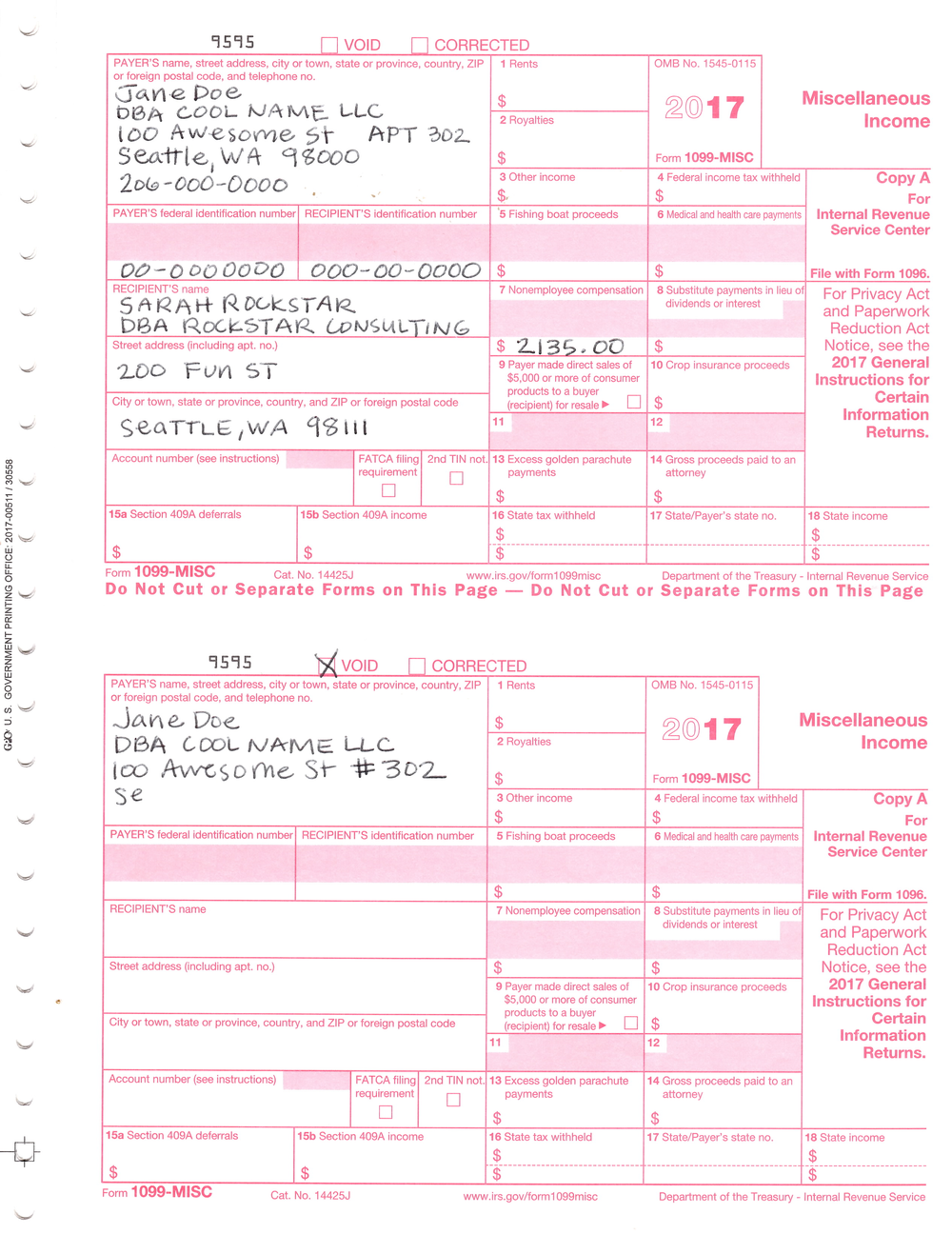

Forms 1099 are provided by the payer to the IRS, with a copy sent to the recipient of the payments These forms alert the IRS that this money has changed hands Taxpayers generally don't have to file their 1099s with the IRS because the IRS already has the form, but they do have to report the income on their tax returns The 1099MISC has Copy A, B, C, 1 and 2 Copy A is sent to the IRS along with the 1096 Copy B is sent to the recipient and the recipient keeps that copy The payer or the business issues the 1099MISC forms to vendors/contractors should retain Copy CMail form 1096 and Copy A of each 1099 form to the IRS Maryland taxpayers must mail copies to Department of Treasury Internal Revenue Service Center Kansas City, MO Step 5 Give or mail Copy 1, Copy 2 and Copy B to the subcontractor listed on the respective 1099 form Keep Copy C for your records

1

1099 Misc Copy C State Laser W 2taxforms Com

Most state copies of income statements are due to Treasury on or before January 31The Affordable Care Act Filer for 1099etc by Advanced Micro Solutions can help you save time and money by providing you with the tools to meet your ACA reporting needs The ACA Filer supports Affordable Care Act reporting, and it will automatically fill in Form 1095B, Form 1095C, and the associated 1094 transmittal forms for printing on File Copy A of form 1099NEC with the IRS by , if you file electronically (same as paper deadline) File Copy A of form 1099MISC with the IRS by , if you file electronically Combined Federal State / Filing Support The CF/SF Program forwards original and corrected information returns filed electronically through

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

Bintfed05 1099 Int 2up Federal Copy A Greatland Com

Copy 1 is for the state tax department and Copy 2 is for submission with the recipient's state income taxes, where applicable Copy C, on the other hand, is the employer's to keep on file Make sure you keep a copy of every 1099 you file each year in the event your business is ever audited by the IRS AdvertisementFor tax year , organizations must send Copy B of form 1099NEC to the recipient by and file Copy A of the form with the IRS by These dates apply for both paper and electronic filing What is the minimum amount for completing a 1099NEC form?Identifying where you had bank or retirement accounts;

/how-to-prepare-1099-misc-forms-step-by-step-397973-final-HL-ccf162add47a4d61bb61fca1ea3e3c62.png)

How To Prepare 1099 Nec Forms Step By Step

2

Applying for loans or benefits;Official 1099R Forms Use the 1099R Payer or State Copy 1/D to print and mail payment information to the State (if required) or for payer filesNumber of W2 and/or 1099 Forms included Send this completed transmittal form along with copies of your W2 and/or 1099 statements to VA Department of Taxation PO Box Richmond, VA Form VAW W2/1099 Transmittal This form is to be used to submit W2/1099 statements on paper

1099 Nec Copy C 2 Laser Form 50 Sheet Pack Neclmc2 8 14 Monarch Accounting Supplies For All Your Accounting Tax Form Needs

Year End 1099 Misc State Copy 1 Forms P

1099MISC Miscellaneous Income Federal Copy A 2up $900 SKU LMA Miscellaneous Income 1099MISC 2up Federal Copy A form Order the quantity equal to the number of recipients for which you file Plus FREE SHIPPING to the continental 48 statesFiling deadline (if paper filing) ; Beginning , Pennsylvania is imposing a withholding obligation for some payors of Pennsylvania source income and lessees of Pennsylvania real estate to nonresidents The legislation also expanded the rules requiring when a copy of Federal Form 1099MISC must be filed with Pennsylvania

1099 Nec Form Copy B C 2 3up Zbp Forms

1099 Nec Form 21 1099 Forms Zrivo

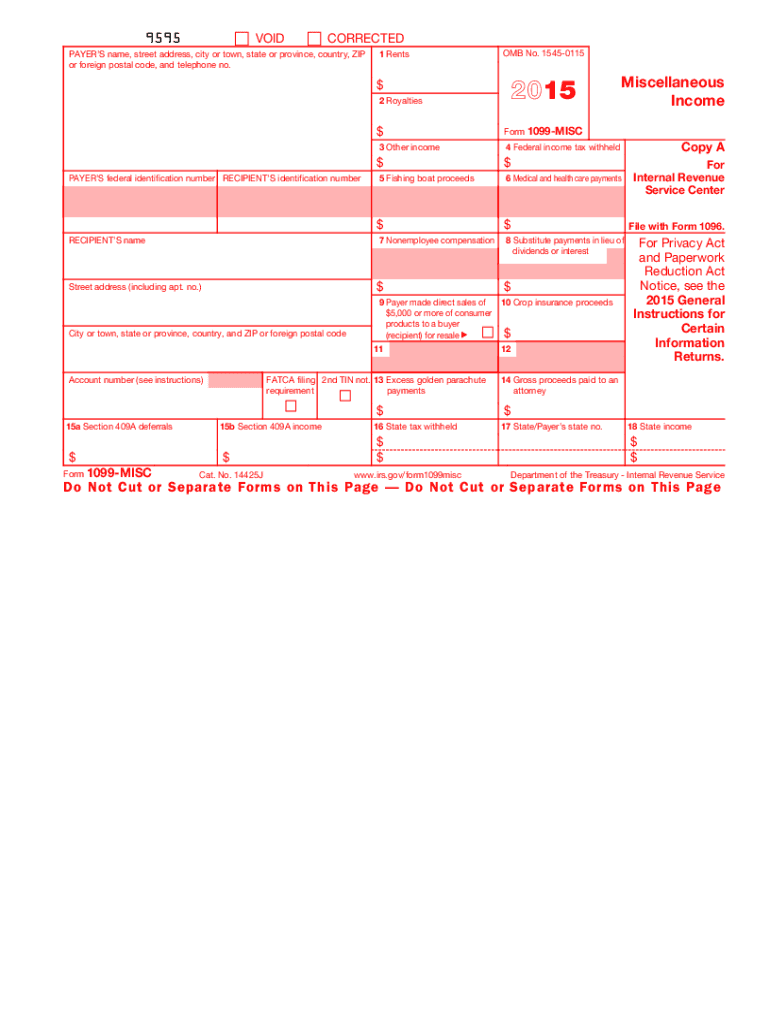

AtlantaTaxExpert Posts 21,815, Reputation 846 Senior Tax Expert , 0922 PM The RED copy goes to the IRS As long as the SSA, state, city and individual gets legible copies, it really does1099MISC 19 Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the 19 General Instructions for Certain Information Returns 9595 VOID CORRECTEDTitle RS1_DRAFT_pdf Author TraphaC Created Date AM

Irs Form 1099 K Payment Reporting Under California Ab 5

1099 Software User Guide Note This Is Intended To Be A General Guide To Introduce You To The Ftwilliam Com 1099 Software Features And Structure More Details Are Often Provided At Ftwilliam Com And Through Free Webinars Preformed Throughout The Year At

Step 1 Determine who is a contractor The first step is determining which of the people you work with are contractors and which are employees This amounts to a 1099Tracing your income history;Filing Deadline Forms W2 for tax year are due on or before We adjust due dates that fall on a weekend or staterecognized holiday to the next business day If the IRS has granted you an extension of time to file a federal information return due to a natural disaster or other approved reason, you must submit your Forms W2 to the Illinois Department of Revenue

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

1099 Tax Forms All Tax Forms Available Order Early For Best Pricing

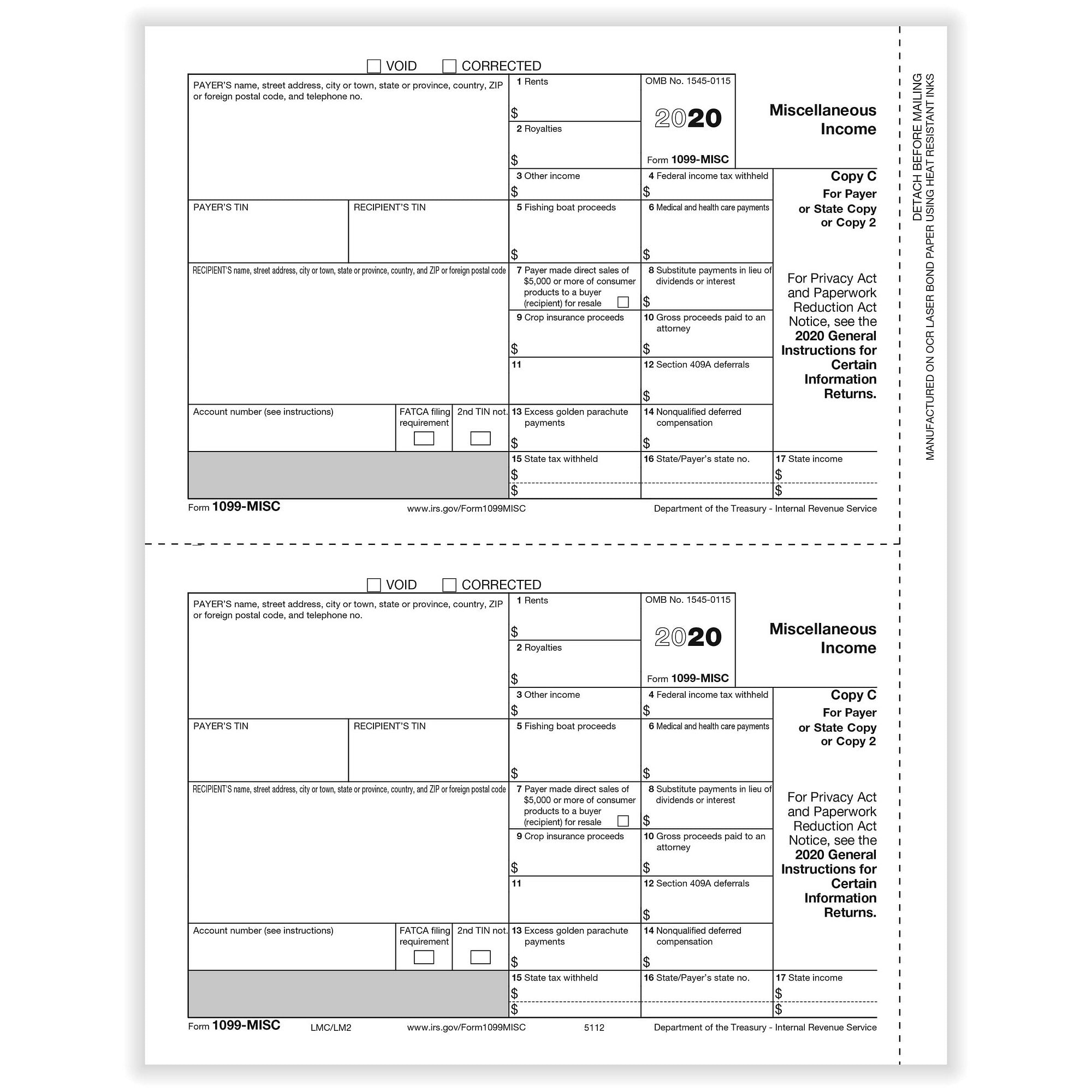

Are extensions available if I can't file information returns (Forms 1099MISC, 1099NEC, and 1099R) by the due date? Official 1099MISC Forms for Payer State Copy C and File Copy 2 Print both Payer 1099MISC form copies on a single sheet!Copy B Independent contractor;

Tax Form 1099 Div Copy C 1 Payer State 5132 Form Center

Form 1099 Nec Requirements Deadlines And Penalties Efile360

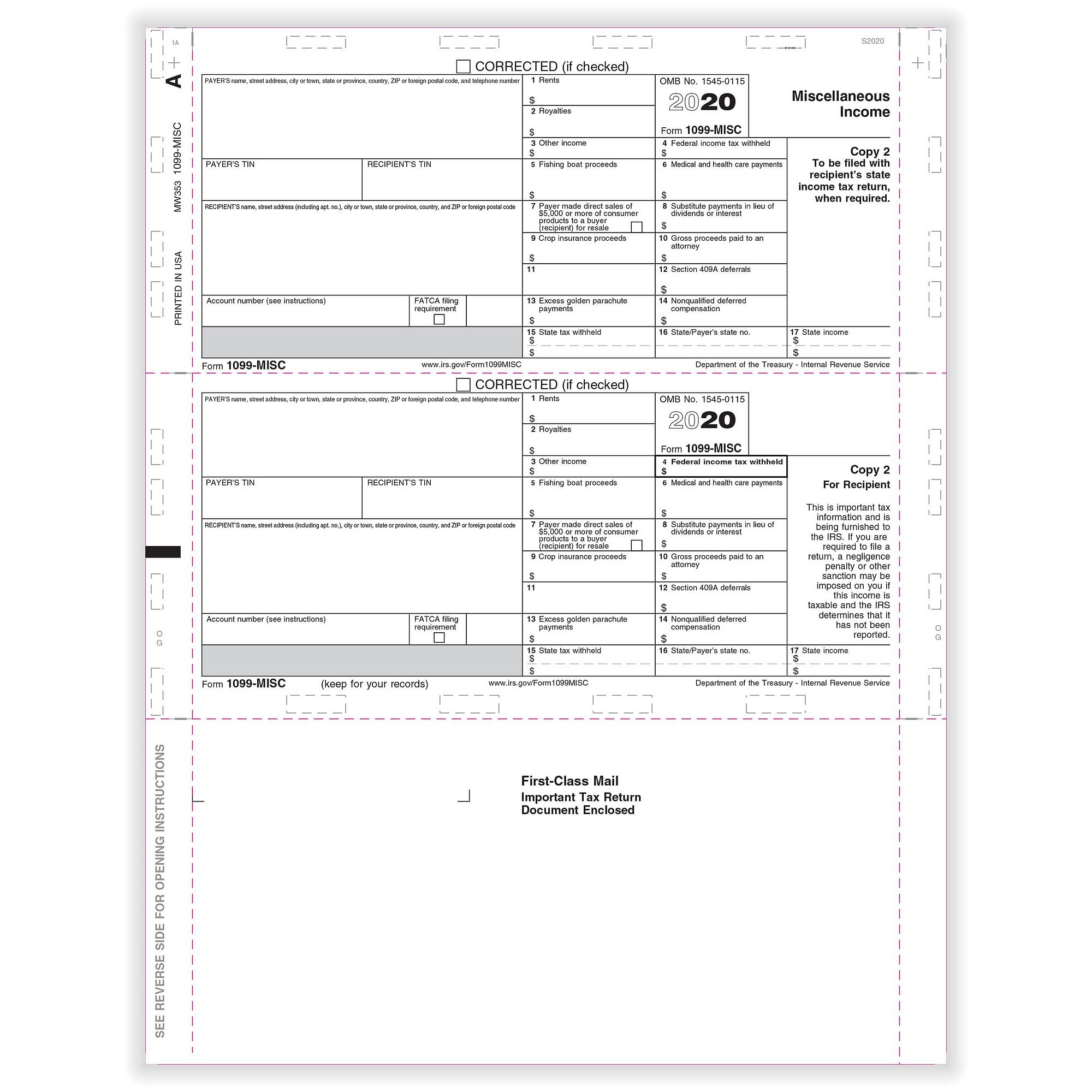

Know the Different Copies of a 1099 Form For many employers, all five copies of the 1099 form are essential Copy A—Goes to the IRS Copy 1—Goes to the state tax agency Copy 2—Goes to the recipient Copy B—Goes to the recipient Copy C—Stays with employer for record keepingThe IRS has them for the past 10 years – here's how to get themPrinted on # laser paper;

Form 1099 Misc Miscellaneous Income Irs Copy A

1099 S Tax Form Copy A Laser W 2taxforms Com

P (Taxable in a prior year of the 1099R year – the year the refunded contribution was made) *Nonqualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box 2A DWC Notes All hardships under the age of 59 1/2 must useYou may request a 30day extension for filing Forms 1099MISC, 1099NEC, and 1099R with the department, but the due date for furnishing a copy of the information return to the recipient cannot be extendedThe 1099 MISC comprises of a total of 5 parts These are as follows Copy A This is submitted to the IRS by the taxpayer (ie your business) Copy 1 This part is sent to the state tax department by the taxpayer Copy B The taxpayer receives this (Before January 31 st)

E Filing 1099s Youtube

1099 Nec Form Copy C 2 Payer Discount Tax Forms

The 1099NEC is a multipart form that is handled as follows Copy A — File with IRS by the paper or electronicfiling deadline Copy 1/State Copy — File with the appropriate state taxing authority, if applicable Copy B — Distribute this copy to individuals, Missouri requires you to file Form 1099NEC with Missouri Department of Revenue if the amounts are $1,0 or over Business owners in Missouri can file Form 1099NEC with Wave Payroll, and Wave completes both IRS and Missouri Department of Revenue filing Learn how to generate and file Form 1099NEC with Wave hereSection 331) When are state copies of income statements due?

2

Form 1099 Int Irs Copy A

Copy 1 State tax department, if applicable; Where to Get Form 1099NEC You can get 1099NEC forms from office supply stores, directly from the IRS, from your accountant, or using business tax software programs You can't use a form that you download from the internet for Form 1099NEC because the red ink on Copy A is special and can't be copied You must use the official formA replacement SSA1099 or SSA1042S is typically available for the previous tax year after February 1 If you don't have access to a printer, you can save the document on your computer or laptop and email it Sign in to your my Social Security account to get your copy

1

1099 Misc Copy A Laser W 2taxforms Com

Treasury requires 1099MISC state copy filing per MCL 6707(1) Treasury has the authority to require 1099NEC state copy filing per Internal Revenue Code (IRC Chapter 61; 1099 Misc copy 1 Where do you send 1099misc copy 1 08?1099 Copy A is the copy you send to the IRS (Internal Revenue Service) And yes this is the copy you need to send with form 1096 So for example if you had 4 independent contractors, then you need to send 4 1099MISC Copy A forms to the IRS along with 1 form 1096 that summarizes the information in those 4 forms

1099nec Tax Form Copy A For Federal Irs Filing Zbp Forms

What Is Form 1099 Nec Who Uses It What To Include More

Copy C Keep in your business records; It is also important to send copies of the form to the recipients before the deadline Here are the due dates for Form 1099MISC for tax year Due to sending recipient copies ;Does it get sent to your state tax dept or your receiptants state tax department?

Www State Nj Us Treasury Taxation Pdf Other Forms Git Er 05njwt1099 Pdf

Amazon Com Egp Irs Approved 1099 R 4 Up Pressure Seal Preprinted 1 Carton Of 500 Tf5177 Tax Record Books Office Products

Copy A The IRS;Find the explanation for box 7 codes here 1099R Box 7 Distribution Codes 1 (1) Early distribution, no known exception (in most cases, under age 591/2) (See Form 5329 ) For a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329 See the instructions for Form 1040;The 1099MISC is a multipart form that is handled as follows Copy A — File with IRS by the paper or electronicfiling deadline Copy 1/State Copy — File with the appropriate state taxing authority, if applicable Copy B — Distribute this copy to individuals,

Tax Form 1099 Int Copy C 1 Payer 5122 Form Center

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Copy 1 is for you to file with your state when required (Not all states require you to submit this copy when you file Copy A electronically with the IRS) Please check with your state tax agency for state 1099MISC requirements When filing state copies of forms 1099 with Pennsylvania department of revenue, the agency contact information is PA Department of Revenue, PO Box , Harrisburg, PA Compliance rules Payers of nonemployee compensation for Pennsylvaniabased work or Pennsylvaniasource oil/gas lease payments are required to submit copies of federal forms 1099MISC / 109916 or more $598 Use Form 1099INT to report interest of $1000 or more, taxable or nontaxable, and to report any federal or foreign income tax withheld and not refunded, paid in the course of your trade or business This copy is for the State 2 Forms per page Price is for a package of 25 pages = 50 Recipients

Amazon Com 1099 Misc Forms 4 Part Tax Forms Kit For 25 Individuals Income Set Of Laser Forms Designed For Quickbooks And Accounting Software 1099 Tax Forms Office Products

1099 Misc Miscellaneous 2 Up Federal Copy A Creative Document Solutions Llc

85″x 11″ with no side perforation;Some states require you to send them a copy of the 1099 forms you filed with the IRS Other states don't require you to send a copy because they participate in the Combined Federal/State Filing Program (CF/SF) The CF/SF Program was created to simplify information returns filing Through the CF/SF Program, the IRS electronically forwards 1099 formsEach Form 1099 comes with 5 copies, so make sure to write or type on the top copy so it transfers down onto each copy, like carbon paper Send Copy A to the IRS, Copy 1 to the appropriate state tax agency, Copy B and Copy 2 to the income's recipient (they get two copies so they can attach one to their return and keep one), and keep Copy C for your records

Form 1099 Misc Miscellaneous Income Editorial Stock Image Image Of Service Internal

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Copy 2 Independent contractor; Form 1099NEC Report payments for rents, royalties, prizes, medical/healthcare payments, backup withholding, and other Report payments to nonemployees, including independent contractors, small businesses, attorneys, and individuals Due date February 28 of the year after the tax year On the tax form 1099 misc there is a copy c,copy 1,copy 2,i just started my business and i need to figure out which Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Int Interest Income State Copy 1

1099 Misc Form Fillable Printable Download Free Instructions

Cg054 Form 1099 G Certain Government Payments 3 Up 5 Part Carbonless Greatland Com

Form 1099 R Wikipedia

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

New 1099 Nec Federal Copy A 100 Pkg New Medical Forms

Verticalive Forms

3

Http Www Pcsai Com W2 Helpful Info Page Pdf

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

Tax Form 1099 R Copy B Recipient Condensed 4up 5175 Mines Press

Nagforms Laser 1099 Nec Payer State Copy C 100 Pk Neclmc

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

1099 Misc Laser Federal Copy A

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Misc Miscellaneous Income Info Copy Only

1099 Nec Forms Set Zbp Forms

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Int Recipient Copy B

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients The Southern Maryland Chronicle

1099 Laser Misc Federal Copy A Item 5110

What Is The 1099 Form For Small Businesses A Quick Guide

Form 1099 Div Dividends And Distributions State Copy 1

Understanding 1099 Form Samples

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

Form 1099 Misc Instructions And Tax Reporting Guide

15 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Forms Fulfillment Center Sbt Executive Series Checks Forms

How To File Form 1099 Nec For Contractors You Employ Vacationlord

Form 1099 Misc Miscellaneous Income State Copy 1

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec

1

Startchurch Blog Updates You Must Know 1099 Misc 1099 Nec

Acumatica 1099 Nec Reporting Changes Crestwood Associates

Form 1099 Nec It S Back Brown Nelms

1099 S Transferor Copy B For 50 Recipients Forms Recordkeeping Money Handling Office Supplies Ekoios Vn

1099 Int Payer Copy C Or State

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

1099 Misc Copy B Laser W 2taxforms Com

1099 Laser Misc Payer Copy C Item 5112

1099 Int Forms Set With Envelopes Discount Tax Forms

1099 Nec Form Copy B Recipient Zbp Forms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

Tax Form 1099 R Copy D 1 Payer State 5143 Form Center

And 1096 Transmittal Forms Compatible With Quickbooks 1099 Misc Miscellaneous Income Preprinted 4 Part 2 Up Taxpacks With Envelopes Self Seal Irs Approved Qty For Vendors Suppliers Office Products Office Supplies Sailingschool Pl

1099 Nec Form Copy B 2 Zbp Forms

Brb05 Form 1099 R Distributions From Pensions Etc Copy B Recipient

Tax Form 1099 Nec Copy A Federal Nec5110 Mines Press

11 Pressure Seal 1099 Misc Form Z Fold Recipient Copies B 2 Nelcosolutions Com

Printable 1099 Forms Copy B Fill Online Printable Fillable Blank Pdffiller

What Is Form 1099 Nec Who Uses It What To Include More

1099 Misc Miscellaneous Payer State Copy C Cut Sheet 400 Forms Pack

1099 Misc Tax Form Pressure Seal W 2taxforms Com

Form 1099 Misc Miscellaneous Income And Blue Pen With Dollar Bills Lies On Office Calendar Internal Revenue Service Tax Form Stock Photo Image Of Deductions Copy

1099 Misc Miscellaneous 2 Up Horizontal Copy B 2 11 Z Fold 500 Forms Ctn

1099 Misc Form 19 Print 1099 Form 1099 Online Filing For 19

Form 1099 Nec Instructions And Tax Reporting Guide

Ints305 1099 Int Interest Income Preprinted Set 3 Part Greatland Com

1099 Int Laser Recipient Copy B

1099 Misc Form Copy B C 2 3up Zbp Forms

Office Depot

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Bookkeeping Financial Planning For Couples Bookkeeping Business

1099 Nec Federal Copy A Cut Sheet Hrdirect

How To Read Your 1099 Robinhood

Will I Receive A 1099 Nec 1099 Misc Form Support

0 件のコメント:

コメントを投稿